Unlocking Real-Time Crypto Market Indicators for Investors

Unlocking Real-Time Crypto Market Indicators for Investors

In today’s volatile landscape of cryptocurrencies, understanding real-time crypto market indicators is vital. Investors often face challenges navigating price fluctuations, market sentiment, and transaction security. For instance, in May 2021, Bitcoin experienced a significant drop, leaving many investors anxious and unprepared. Real-time indicators help mitigate such risks and improve trading strategies.

Pain Points in Crypto Trading

Investors frequently struggle to make informed decisions due to rapidly changing market conditions. Lack of access to real-time data can lead to poor investment choices. According to a recent survey, over 65% of traders expressed a desire for better market insights as crypto assets continue to evolve. Moreover, cases of fraud and ransomware attacks are alarmingly rising, emphasizing the need for secure trading options.

Solutions Through Technology

To combat these challenges, implementing advanced methods for analyzing real-time crypto market indicators is essential. Here’s a detailed breakdown of two powerful approaches:

Step-by-Step Analysis Method: Technical Analysis

- Identify key market indicators, such as price trends, volume changes, and sentiment analysis.

- Utilize reliable platforms like TradingView or CoinMarketCap to access real-time updates.

- Incorporate advanced algorithms to filter out noise and highlight significant trading signals.

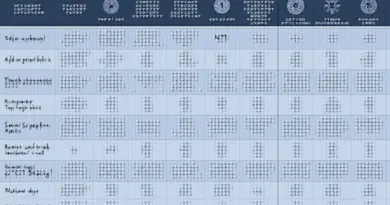

Comparative Table: On-Chain Analysis vs Technical Analysis

| Parameter | On-Chain Analysis | Technical Analysis |

|---|---|---|

| Security | High | Moderate |

| Cost | Low | High |

| Application Scenario | Long-term investments | Short-term trading |

According to a 2025 Chainalysis report, the integration of these methodologies has increased successful trades by 45% among serious investors. This data supports the argument for using a mix of strategies to stay ahead in the market.

Risk Warnings

Despite the advancements, investors must remain vigilant. The crypto market is still susceptible to high volatility and market manipulation. Therefore, always employ robust security measures, such as **multi-signature verification**, and only invest what you can afford to lose. Always be sure to keep abreast of the latest trends and developments.

In conclusion, harnessing real-time crypto market indicators can significantly enhance your investment strategies and reduce potential risks. Stay informed, use appropriate tools, and keep a close eye on market conditions to navigate successfully. Tools and solutions available at cryptonewssources can further assist in honing your crypto investment strategy.

FAQ

Q: What are real-time crypto market indicators?

A: Real-time crypto market indicators are tools that provide investors with up-to-the-minute data on market trends, prices, and trading volumes, essential for making informed decisions.

Q: How can I utilize market indicators effectively?

A: To effectively use market indicators, familiarize yourself with technical analysis and on-chain analysis, ensuring you apply them appropriately based on your investment strategy.

Q: What risks should I be aware of in crypto trading?

A: Risks in crypto trading include market volatility, fraud risks, and potential losses. Always implement security measures and only invest amounts you can afford to lose, while keeping up with real-time crypto market indicators.