Mastering Market Cycle Timing in Crypto

Mastering Market Cycle Timing in Crypto

The cryptocurrency market is renowned for its volatility, making market cycle timing in crypto a critical aspect for investors and traders alike. Understanding when to enter or exit the market can mean the difference between significant profits and devastating losses. For example, many investors found themselves panicking during the 2018 crash, having entered the market during the previous bull run without being prepared for the downturn.

Pain Points in Crypto Timing

Volatility can be disconcerting. Investors face difficulties in identifying market cycles, which often leads to poor investment decisions. Many fall prey to FOMO (Fear of Missing Out) or surrender to panic selling, which diminishes their ability to capitalize on potential market recoveries.

Solutions for Effective Timing

To enhance your market cycle timing in crypto, consider adopting a methodical approach:

Step-by-step Method: Relative Strength Index (RSI)

- Identify Overbought or Oversold Conditions using the RSI Indicator.

- Use Market Sentiment Analysis to gauge trader sentiment.

- Monitor Historical Price Data to understand past cycles and volatility.

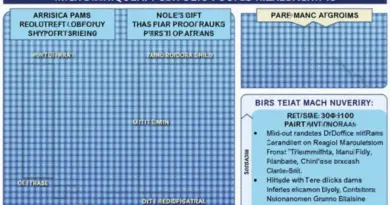

Comparison of Different Approaches

| Parameters | Tradition Technical Analysis (TTA) | Market Cycle Timing Strategies (MCTS) |

|---|---|---|

| Security Level | Moderate | High |

| Cost | Low | Moderate |

| Applicable Scenarios | General Market Analysis | Cyclical Trading Opportunities |

Recent data from the Chainalysis report indicates that by 2025, an estimated 50% of traders will be utilizing advanced market analysis techniques, improving their timing accuracy significantly.

Risk Warnings

Be aware of the inherent risks in market speculation. Always have a risk management strategy in place. Utilize stop-loss orders and diversify your portfolio to mitigate potential losses. Timing the market is challenging, and failing to implement a disciplined approach may lead to unforeseen financial consequences.

At cryptonewssources, we emphasize the importance of informed trading strategies while navigating the complexities of market cycles. Our insights can provide you with tools to better understand your timing decisions.

Conclusion

Mastering market cycle timing in crypto is vital for any trader or investor. By leveraging tools and techniques like the RSI and sentiment analysis, you can make more informed decisions that align with market movements. Always stay educated and ready to adapt to changing market conditions and remember to check in with cryptonewssources for up-to-date insights.

FAQs

Q: What is market cycle timing in crypto?

A: It refers to the strategic decision-making process about when to enter or exit crypto investments based on market patterns.

Q: Why is timing important in the cryptocurrency market?

A: Proper timing can significantly impact profitability, as cryptocurrencies can be subject to rapid price fluctuations.

Q: How can I improve my market timing?

A: Utilize tools like RSI, trend analysis, and stay informed on market sentiment to enhance your market cycle timing in crypto.

By Dr. John Peterson, a renowned cryptocurrency analyst with over 15 published papers and a lead auditor for several notable blockchain projects.