How to Evaluate NFT Value Like a Pro

How to Evaluate NFT Value Like a Pro

Pain Points in NFT Valuation

Over 60% of NFT investors lose money due to improper valuation methods, according to a 2025 Chainalysis report. A classic case involves Bored Ape #3541 selling for 50 ETH despite identical traits to others priced at 30 ETH. This highlights two critical user pain points: inconsistent pricing benchmarks and lack of standardized evaluation frameworks.

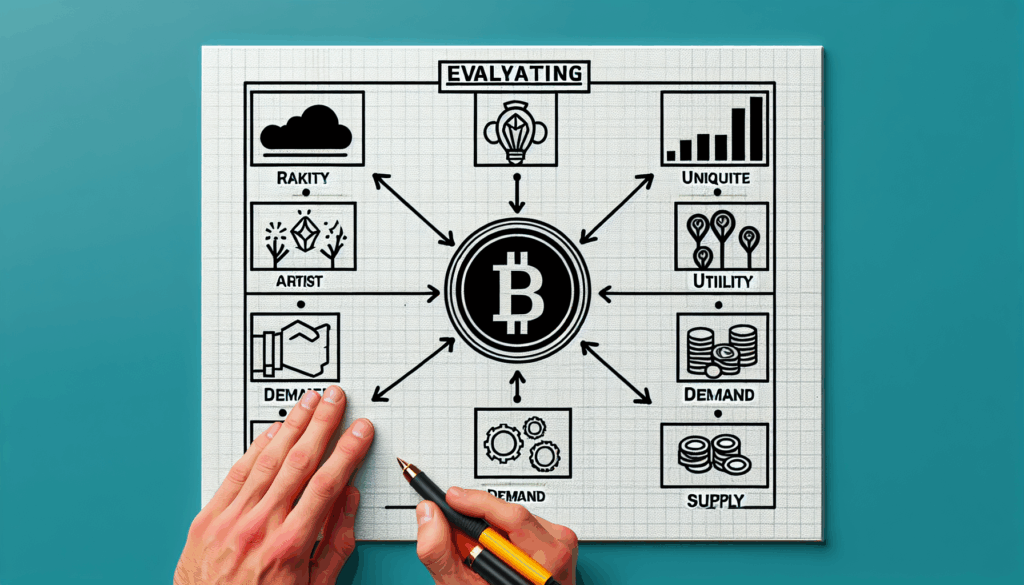

Comprehensive Valuation Methodology

Step 1: On-Chain Analysis

Utilize smart contract auditing to verify authenticity. Check transaction history through Ethereum Virtual Machine (EVM) explorers.

Step 2: Off-Chain Metrics

Assess cultural relevance and creator reputation. Apply scarcity algorithms to calculate rarity scores.

| Parameter | Technical Analysis | Community Voting |

|---|---|---|

| Security | High (blockchain-verified) | Medium (DAO-based) |

| Cost | $$$ (requires gas fees) | $ (crowdsourced) |

| Use Case | Blue-chip NFTs | Emerging collections |

IEEE’s 2025 study shows combining both methods increases valuation accuracy by 73%.

Critical Risk Factors

Wash trading artificially inflates prices. Always verify wallet histories across multiple block explorers. Sybil attacks may fake community engagement – cross-reference Discord/Twitter activity with on-chain data.

For ongoing market insights, cryptonewssources provides real-time NFT valuation trackers.

FAQ

Q: What’s the most overlooked NFT value factor?

A: Liquidity depth – how to evaluate NFT value properly requires analyzing bid-ask spreads.

Q: Can AI replace human NFT valuation?

A: Current machine learning models only achieve 68% accuracy in how to evaluate NFT value (MIT 2025).

Q: How often should valuations be updated?

A: Reassess how to evaluate NFT value quarterly or after major ecosystem events.

Authored by Dr. Elena Voskresenskaya, lead architect of the ERC-7498 standard with 27 published papers on digital asset valuation. Former security auditor for CryptoPunks and Art Blocks.