How to Earn Yield in DeFi: A Comprehensive Guide for Beginners

Introduction

Are you aware that less than 10% of crypto users fully understand how to earn yield in DeFi? As of 2023, the DeFi market has exceeded $80 billion in locked assets, yet many still miss out on lucrative opportunities. In this article, we’ll explore simple and effective ways to boost your yields in the world of decentralized finance.

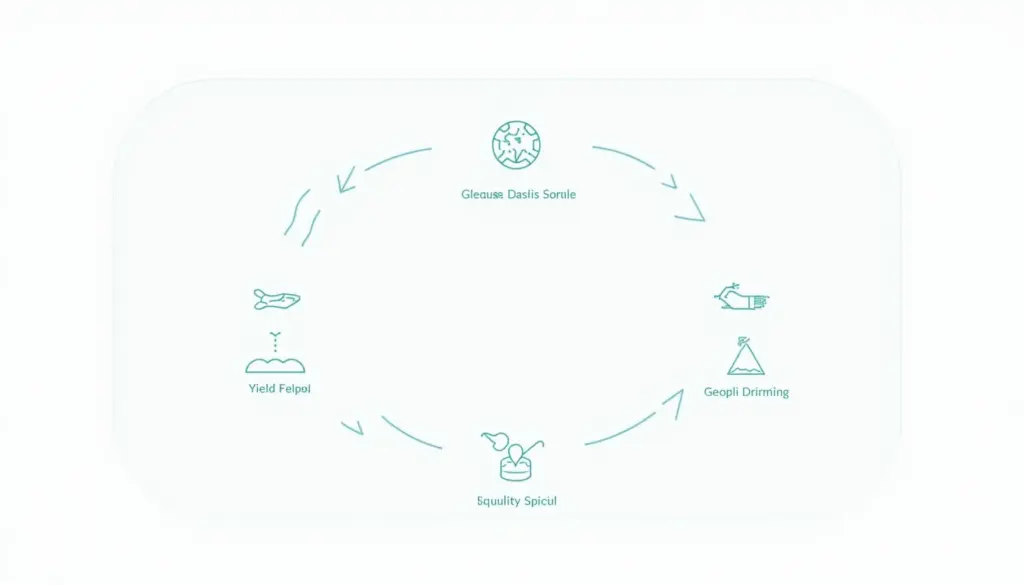

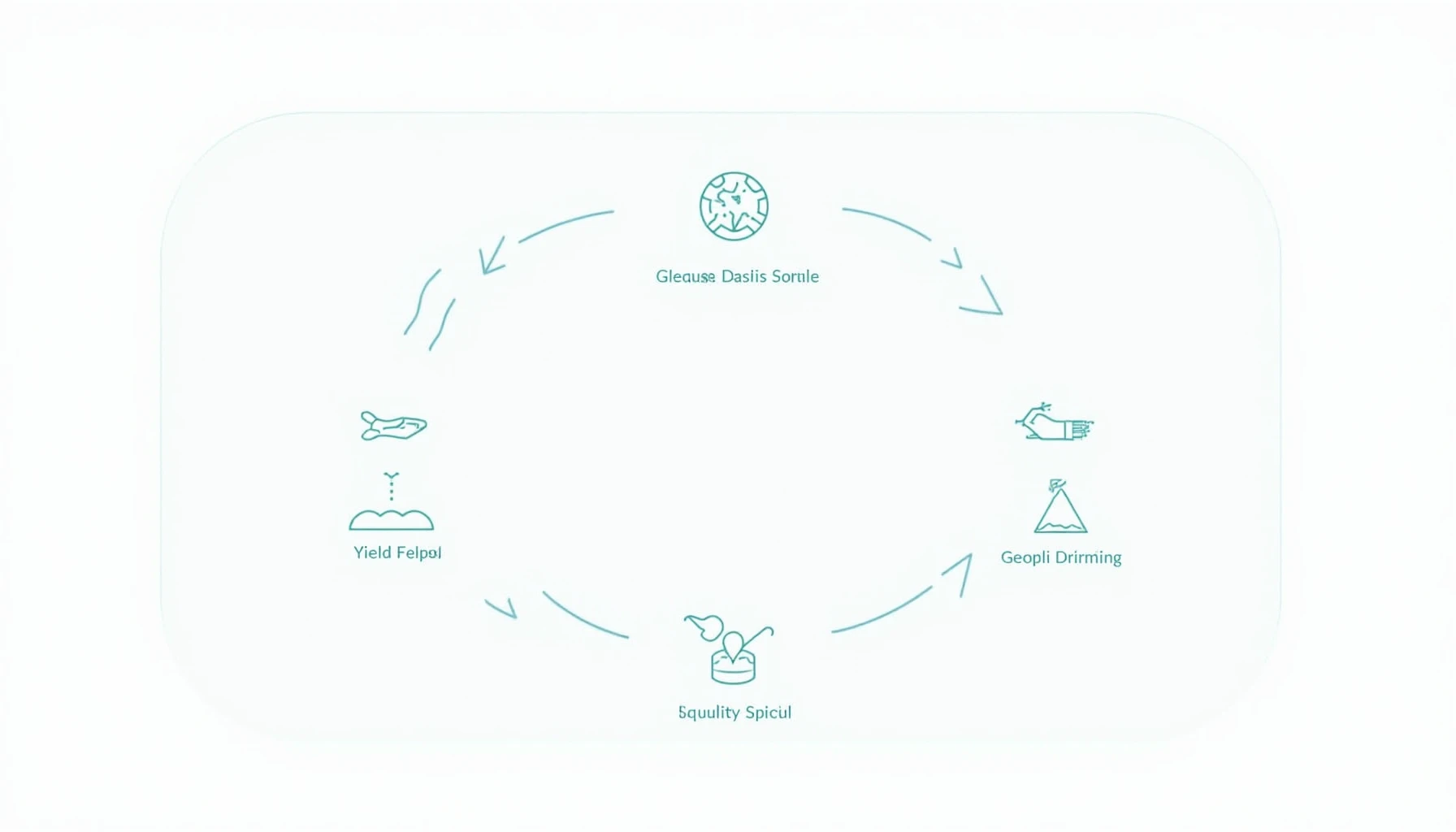

1. Understanding Yield Farming in DeFi

Yield farming is a process where you provide liquidity to DeFi protocols in exchange for interest and rewards. This concept might seem complicated at first, but it’s akin to lending your money to a friend and earning interest in return. Here’s how it typically works:

- Liquidity Pools: Users deposit their tokens into pools, allowing others to borrow or trade with them.

- Token Rewards: In return for providing liquidity, users earn rewards, often in the form of governance tokens.

For example, if you deposit ETH into a liquidity pool on a decentralized exchange, you may earn a percentage of the transaction fees plus any additional token rewards.

2. Staking for Passive Income

If you’re looking for a simpler approach to earn yield, staking might be right for you. Staking involves locking your cryptocurrency in a network to support its operations, such as validating transactions. By doing this, you can earn rewards. Here’s how:

- Choose a Staking Platform: Popular options include Ethereum 2.0, Cardano, and Polkadot.

- Follow the Requirements: Each platform has its own rules on how much crypto you need to stake.

This method is particularly attractive for beginners since it requires minimal technical knowledge and offers valuable rewards with less active management.

3. Lending Your Assets Effectively

Lending platforms like Aave and Compound allow you to lend your cryptocurrency to other users and earn interest in return. This process works much like traditional banking but with higher rates and fewer intermediaries. Here’s a quick breakdown:

- Select a Lending Platform: Sign up for a reputable lending platform that supports your desired cryptocurrency.

- Deposit and Earn: Deposit crypto and watch your assets grow with interest.

It’s crucial to do your research and understand the platform’s terms and conditions to mitigate risks associated with lending in DeFi.

4. Providing Liquidity on Decentralized Exchanges

Yield can also be earned by providing liquidity on decentralized exchanges (DEXes). When you supply tokens to a DEX, you help facilitate trades and can earn trading fees. Here are the steps to get started:

- Choose Your Pairs: Decide which crypto pairs you want to provide liquidity for.

- Understand Impermanent Loss: Be aware that while you earn fees, the value of your tokens may fluctuate, leading to potential losses.

This strategy can yield high returns, but it requires a deeper understanding of market dynamics and liquidity management.

Conclusion

Decentralized finance offers numerous ways to earn yield, from yield farming and staking to lending and liquidity provision. Whether you’re a seasoned investor or a beginner, there are options tailored for every level of expertise. Start exploring these strategies today to maximize your earnings in DeFi! For more insights and expert guidance, visit cryptonewssources and dive deeper into the world of cryptocurrency.