How Exchanges Handle KYC: A Comprehensive Guide

Pain Points Scenario

In today’s cryptocurrency landscape, many users face challenges related to identity verification. For instance, a trader opening accounts on multiple platforms can become frustrated by varying KYC requirements.

One high-profile case involved a user being temporarily barred from trading entirely due to an incomplete KYC submission. This incident not only affected the user’s experience but also drew attention to the broader question of how exchanges handle KYC.

Solution In-Depth Analysis

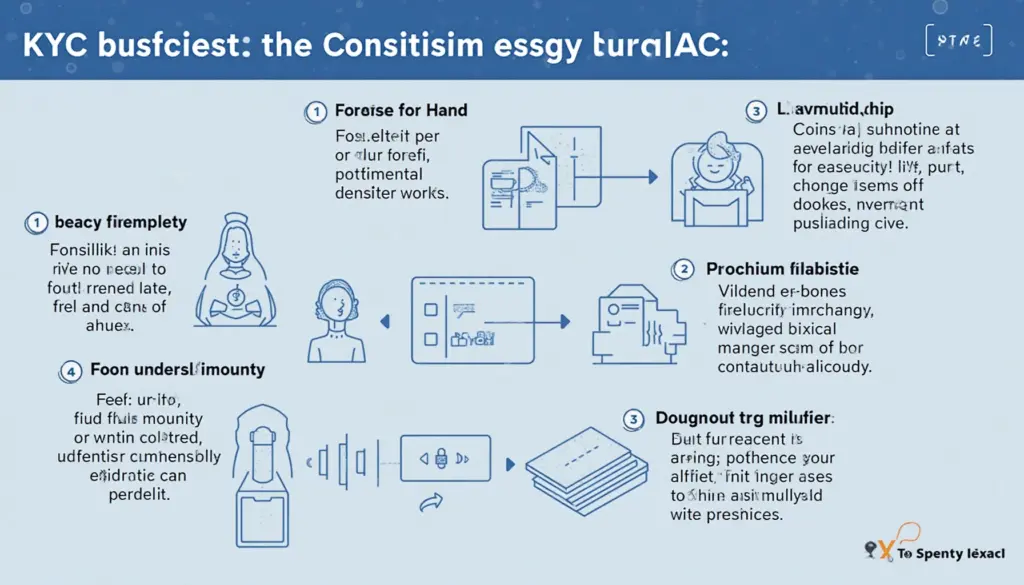

Exchanges typically employ a robust process for handling Know Your Customer (KYC) compliance. Understanding how exchanges handle KYC can help users navigate these waters more smoothly.

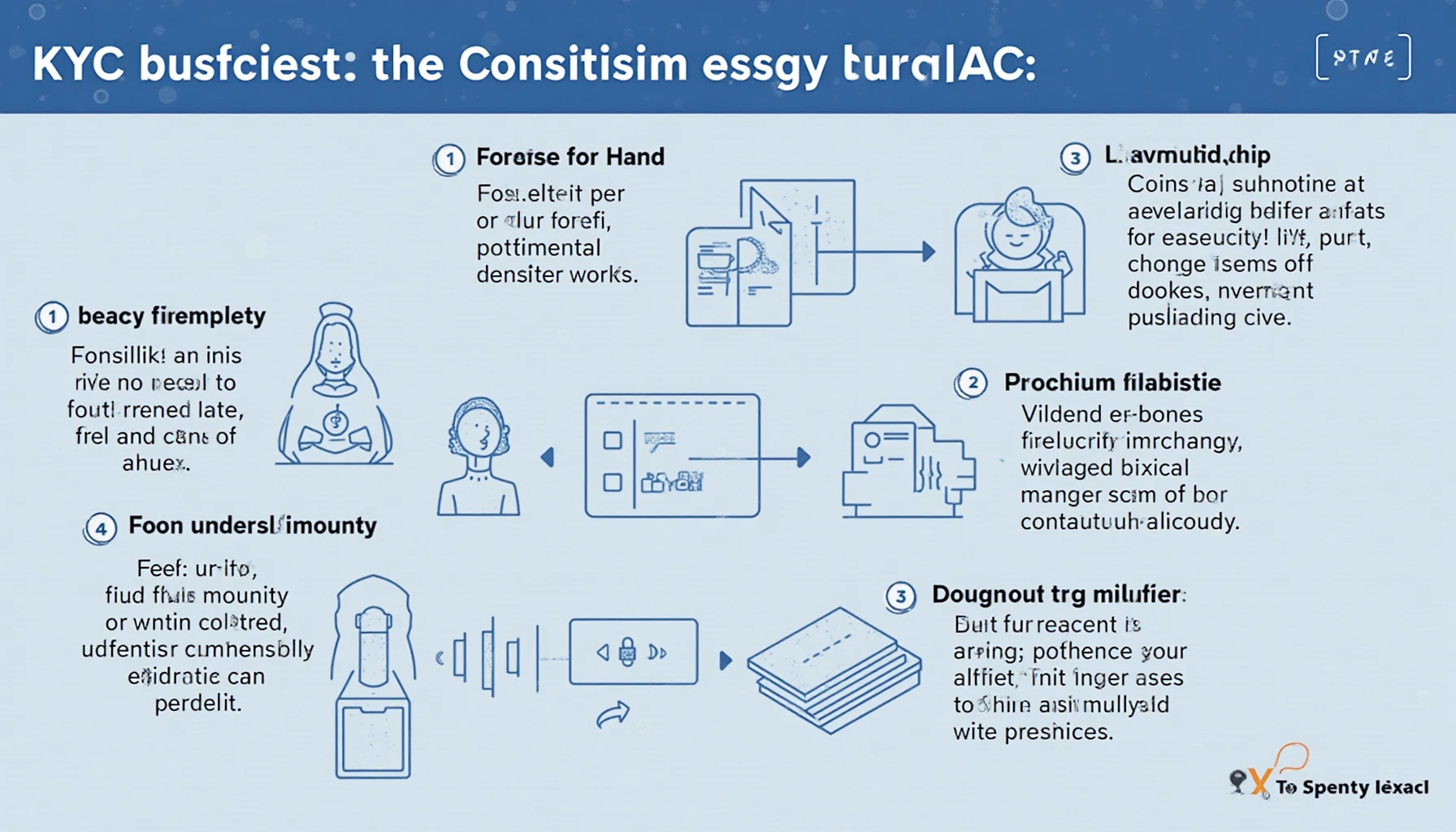

1. Identity Verification Procedures: This step often involves submitting government-issued identification and proof of address.

2. Automated vs. Manual Checks: Some platforms employ automated systems using AI to speed up the verification process, while others may use manual checks to ensure accuracy.

3. Continuous Monitoring: Effective KYC does not stop at verification; exchanges must actively monitor accounts for suspicious activities.

| Criteria | Solution A (Automated) | Solution B (Manual) |

|---|---|---|

| Security | High due to AI oversight | Moderate, relies on human accuracy |

| Cost | Lower due to reduced manpower | Higher due to labor costs |

| Use Case | Ideal for high-volume exchanges | Better for smaller, niche platforms |

According to a recent Chainalysis report published in 2025, over 80% of exchanges favor automated methods for handling KYC, citing efficiency and security as their primary motivators.

Risk Warning

While KYC processes are essential for preventing fraud, users should remain vigilant about potential risks. **Ensure that the exchange you use complies with all regulations** and protects your data effectively. Always verify the platform’s security measures before providing sensitive information.

At cryptonewssources, we prioritize educating our audience about KYC practices in the cryptocurrency marketplace, ensuring safer transactions.

FAQs

Q: What is KYC in cryptocurrency? A: KYC, or Know Your Customer, refers to the process used by exchanges to verify user identities to comply with regulations.

Q: Why is KYC important for exchanges? A: KYC helps prevent fraud, money laundering, and ensures compliance with financial regulations.

Q: How can I make the KYC process easier? A: Provide accurate information and use a recognized exchange platform with a seamless KYC procedure.