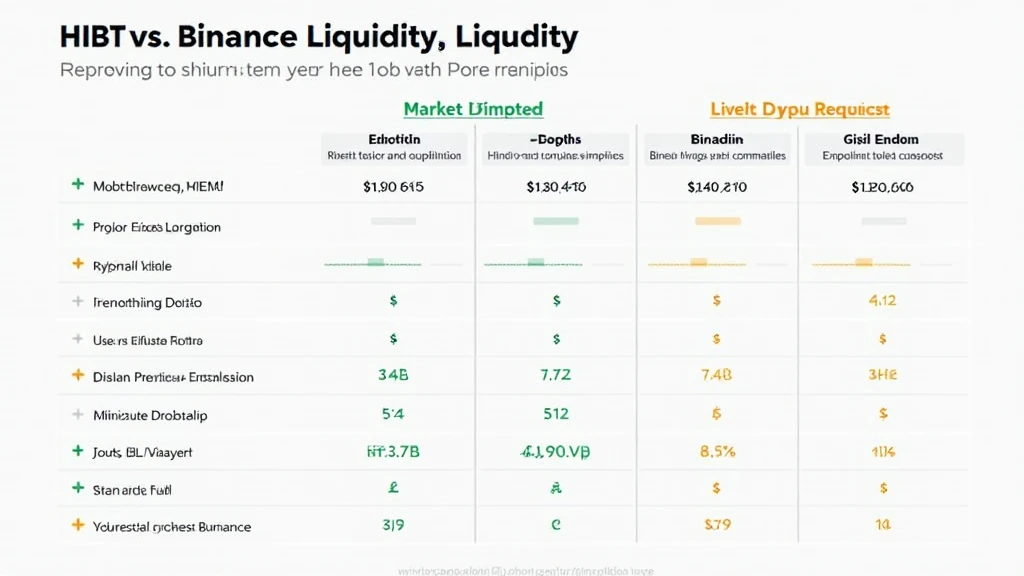

HIBT vs Binance Liquidity Comparison

Understanding Liquidity in Crypto Trading

As the crypto market continues to evolve, traders often look for platforms that offer optimal liquidity. For example, did you know that over $300 million in trades occur daily on Binance? This substantial volume highlights the importance of liquidity in enhancing trading efficiency and reducing slippage.

Liquidity Metrics: HIBT vs Binance

Comparing HIBT and Binance liquidity involves a closer look at several key metrics:

- Trading Volume: Binance dominates with a trading volume of around $2 billion in 2024, while HIBT shows promising growth with a daily volume of $50 million.

- Market Depth: Binance leads with a deeper market, allowing larger trades to occur without significant price movement.

- Order Book Efficiency: HIBT is improving its order book efficiency, featuring fewer price gaps than in previous quarters.

The Impact of Liquidity on Transactions

Liquidity directly influences settlement times and the overall user experience. Just like a high-traffic highway allows quicker travel, a liquid market enables faster transactions. On Binance, users can execute trades almost instantly, while HIBT continues to work on minimizing latency.

Vietnam’s Growing Crypto Market

In recent years, Vietnam has seen a surge in crypto adoption, with a 300% increase in active users reported in 2024. This statistic shows the potential for platforms like HIBT to thrive in emerging markets. Integrating features catering to Vietnamese users is essential.

The Future of HIBT and Binance Liquidity

As we move toward 2025, the liquidity landscape will likely evolve. For HIBT to compete effectively, leveraging partnerships and enhancing technical infrastructure will be critical. Investors keen on long-term growth should consider engaging with platforms that show upward trends in liquidity metrics.

In summary, while Binance currently stands out in terms of liquidity, HIBT is laying the groundwork for significant improvements. With the right strategies, it could emerge as a strong contender in the market.

For more insights on the liquidity dynamics, check our detailed guide at hibt.com.

Note: Not financial advice. Always consult local regulators regarding trading activities.

Conclusion

In the battle of liquidity between HIBT and Binance, current metrics favor Binance. However, HIBT’s growth trajectory presents a promising future. With ongoing enhancements and a growing user base in places like Vietnam, HIBT could potentially catch up.

Stay updated with the latest in the crypto world at cryptonewssources.com”>cryptonewssources.