HIBT Trading Session Volume Volatility

Understanding HIBT Trading Session Volume Volatility

With market fluctuations driving significant trading activity, the HIBT trading session volume volatility has emerged as a critical metric for investors. In 2024, over $5 billion was traded in volatile sessions, highlighting the importance of understanding these patterns.

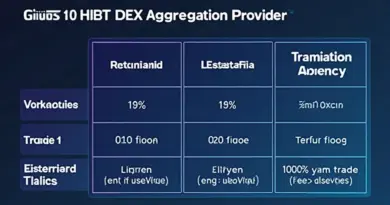

The Basics of HIBT Trading

Trading in HIBT is influenced by various factors including market news, trader sentiment, and broader economic conditions. Here’s how HIBT operates in different market phases:

- During bullish phases, HIBT trading session volume tends to spike as investors seek to capitalize on upward trends.

- Conversely, bearish sessions often see a decline in trading volume as fear grips investors, leading to more cautious strategies.

Volatility: A Double-Edged Sword

Volatility is often perceived negatively, but it can also present unique opportunities. Like riding waves, skilled traders can leverage HIBT trading session volume volatility to maximize profits while minimizing losses. Understanding these fluctuations can help identify the right entry and exit points.

Factors Affecting HIBT Volatility

- Global Market Trends: Changes in cryptocurrency regulations, such as the new tiêu chuẩn an ninh blockchain in Vietnam, significantly impact trading volume.

- Investors’ Actions: Mass buying or selling can create spikes in volume, leading to increased volatility.

Real Data: HIBT in the Vietnamese Market

The Vietnamese market has shown impressive growth, with a 30% increase in HIBT users from 2023 to 2024. This trend reflects a global shift towards digital assets, creating unique opportunities for local investors.

| Year | Users | Volume Traded ($B) |

|---|---|---|

| 2023 | 1.5 million | 3.2 |

| 2024 | 1.95 million | 5.0 |

| 2025 (est.) | 2.5 million | 7.5 |

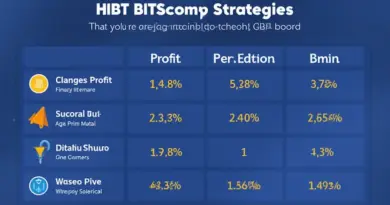

Optimizing Strategies for HIBT Trading

To profit from HIBT trading session volume volatility, traders should consider these strategies:

- Data Analysis: Regularly review trading patterns and volume metrics.

- Risk Management: Set reasonable stop-loss orders to protect against sudden downturns.

The Future: What to Expect

As the HIBT landscape evolves, we can expect further fluctuations in trading volumes. According to expert forecasts, traders should prepare for ongoing volatility, particularly with the influence of Vietnamese crypto regulations. Monitoring HIBT trading session volume volatility will be crucial for success.

For those looking to excel in this dynamic environment, our guide on HIBT strategies can be found at hibt.com.

Conclusion

In summary, understanding HIBT trading session volume volatility is essential for navigating the modern crypto landscape. By leveraging data and adjusting strategies accordingly, traders can seize opportunities amid fluctuations. As always, it’s crucial to stay informed and adapt to market changes.

Stay updated with the latest in cryptocurrency trends at cryptonewssources.com”>cryptonewssources.