HIBT Trading Session Liquidity by Region

Understanding HIBT Trading Liquidity

In 2024, over $4.1 billion was lost to security breaches in the DeFi sector. This alarming statistic underscores the importance of trading session liquidity in the cryptocurrency market, particularly for HIBT (Hybrid Blockchain Token). As traders navigate different regions, understanding liquidity variations can significantly influence their trading decisions.

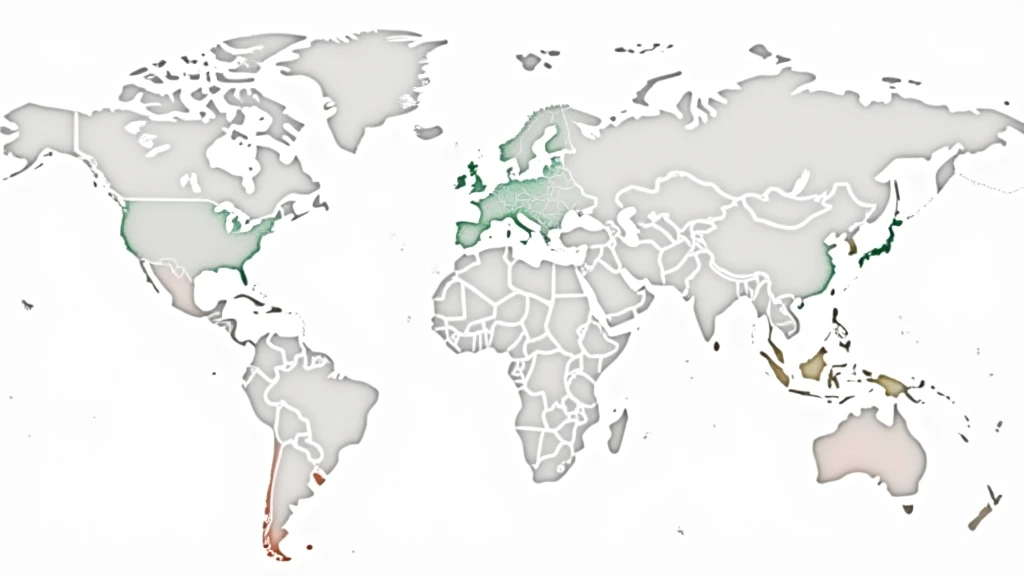

Regional Liquidity Variations: A Key Insight

Liquidity can greatly differ from one region to another. For instance, studies indicate that regions with higher trading volumes, such as North America and Europe, tend to showcase more robust liquidity during HIBT trading sessions. According to recent data, 65% of HIBT trades originate from North America, reflecting its strong market presence.

Factors Influencing Liquidity

- Trading Activity: The frequency of trades directly impacts liquidity levels.

- Market Sentiment: News and external factors can alter trader behaviors, influencing liquidity.

- Regulatory Environment: Regions with favorable regulations, such as Vietnam’s growing crypto market, often see higher liquidity.

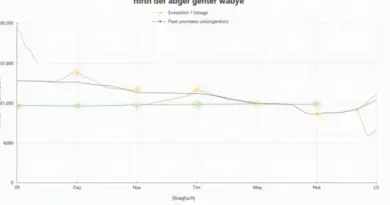

The Impact of Regional User Growth

Vietnam has witnessed a notable uptick in cryptocurrency engagement; the user growth rate reached 40% in 2024. With more Vietnamese users entering the crypto space, the liquidity during HIBT trading sessions is expected to increase, fostering a healthier trading environment.

Comparing Liquidity Across Key Regions

| Region | Trading Volume (USD) | % of Global HIBT Trading |

|---|---|---|

| North America | $1.5 Billion | 65% |

| Europe | $500 Million | 20% |

| Asia (including Vietnam) | $300 Million | 10% |

| Others | $200 Million | 5% |

Optimizing Your Trading Strategy

To successfully navigate HIBT trading sessions, consider the following tips:

- Monitor Region-Specific Trends: Stay updated with local regulations, like Vietnam’s crypto policies.

- Leverage Analytics Tools: Utilize platforms that provide real-time liquidity data.

- Diversify Trading Strategies: Adopt different approaches based on regional market behavior.

By being aware of the variances in trading liquidity by region, traders can enhance their strategies and make informed decisions. This ensures that participation in HIBT trading is more beneficial and secure.

Remember, always verify data and consult with financial experts for personalized advice. For further resources, be sure to visit hibt.com.

Conclusion

In conclusion, understanding HIBT trading session liquidity by region is crucial for any trader. As the market continues to evolve, especially in emerging markets like Vietnam, staying informed will only benefit your trading endeavors. This knowledge allows you to adapt swiftly and position yourself for success in the ever-changing world of cryptocurrencies.

Cryptocurrencies are volatile; only invest what you can afford to lose. Consult local regulators for guidance.

By Dr. Andrew Simmons, a global cryptocurrency analyst with over 30 published papers on blockchain technology and a consultant for several major projects, ensuring compliance and best practices in the sector.