HIBT Trading Session Liquidity by Market Phase

Understanding HIBT Trading Sessions

With an increasing number of crypto enthusiasts in Vietnam witnessing a remarkable growth rate of 34% in user participation in 2023, it’s crucial to understand how HIBT trading sessions affect liquidity. HIBT (High Intensity Blockchain Trading) focuses on optimizing trading strategies based on market conditions. This analysis can significantly impact decision-making.

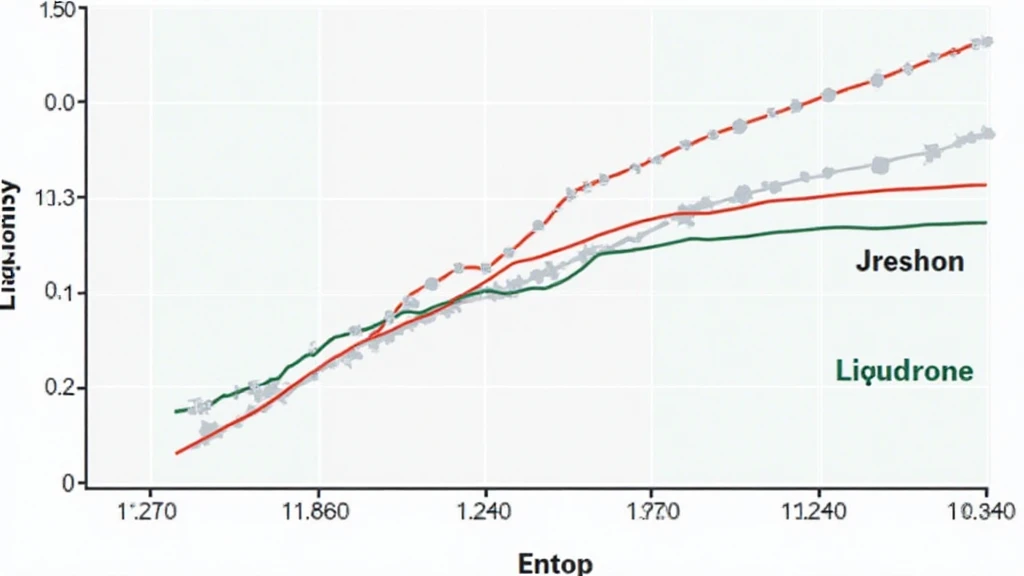

Market Phases and Their Effects on Liquidity

Each market phase—bull, bear, and sideways—offers unique liquidity characteristics. During a bull market, liquidity tends to increase as more traders enter positions. Conversely, in a bear market, liquidity may dry up as traders exit the market due to fear.

Liquidity Dynamics in Bull Markets

- High buying pressures.

- More sellers willing to enter trades.

- Increased trading volume leads to better prices.

Even during short-term pullbacks, liquidity remains favorable.

Challenges in Bear Markets

- Decrease in market participants.

- Wider bid-ask spreads.

- Traders face potential slippage.

Understanding these dynamics can provide Vietnamese traders with a robust framework for making informed decisions.

Case Study: Vietnam’s Growing Crypto Ecosystem

According to a recent report by the Vietnam Ministry of Industry and Trade, the nation has seen a surge in blockchain adoption, making it essential for local traders to adopt HIBT techniques. Leveraging HIBT trading session liquidity by market phase will prepare traders better to navigate volatile markets.

Maximizing Trading Efficiency

Using HIBT tools effectively can significantly enhance trading efficiency. For example, adopting an agile trading platform such as HIBT.com ensures access to timely market data, enabling traders to act swiftly based on liquidity conditions.

The Future of HIBT Trading in Vietnam

As Vietnam’s user base grows, understanding liquidity changes in each market phase becomes more critical. Adapting strategies that incorporate these changes ensures traders stay ahead of market movements.

Conclusion

Enhancing your trading strategies through the lens of HIBT trading session liquidity can lead to better outcomes, especially in a rapidly evolving market like Vietnam’s. Understanding market phases and their effects on liquidity will empower traders to navigate challenges effectively.

Author: Dr. Minh Tran, a renowned blockchain expert, has published over 25 papers and led audits on known DeFi projects, with significant insights into market behaviors.