HIBT Spot vs Futures Basis Spread: Understanding the Differences

Introduction

In the ever-evolving world of cryptocurrency trading, the differentiation between spot and futures markets is crucial for informed decision-making. 2024 witnessed a staggering $4.1 billion lost to DeFi hacks, emphasizing the need for secure trading strategies. This article dives deep into the HIBT spot vs futures basis spread, providing valuable insights for traders navigating these markets.

What is HIBT Spot?

HIBT spot trading involves the immediate purchase or sale of HIBT tokens for cash payment. Traders engage in spot trading to capitalize on current market prices. In Vietnam, the interest in spot trading has surged, with an 80% increase in active traders reported in 2024. This trend underscores the growing confidence in cryptocurrency as an investment.

Understanding Futures Trading

Futures trading, in contrast, allows traders to buy or sell HIBT tokens at a future date for a predetermined price. This market operates on contracts that stipulate the terms of trade, enabling speculative strategies. Like futures contracts for oil, these instruments allow risk management against price fluctuations, which is invaluable for portfolio diversification.

Spot vs Futures: Key Differences

- Liquidity: Spot markets typically provide higher liquidity, while futures may experience volatility.

- Risk: The margin in futures trading can amplify losses, unlike spot trading where you own the asset directly.

- Time Sensitivity: Futures contracts have expiration dates, while spot trades can be executed at the market’s current price.

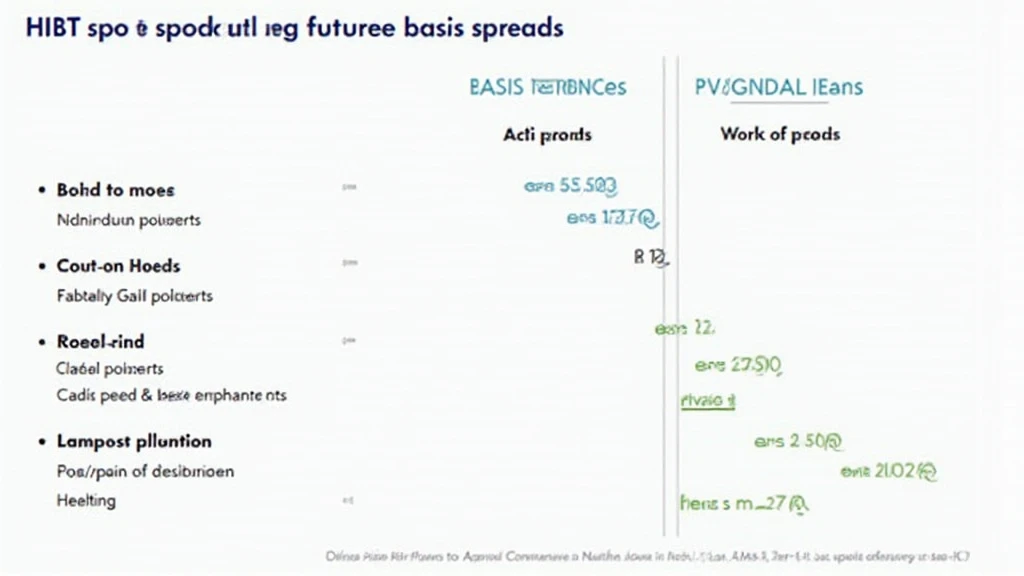

The Basis Spread Explained

The basis spread represents the difference in price between HIBT spot and futures contracts. An increasing basis spread can indicate a bullish market sentiment. Traders must monitor this spread closely, especially in volatile markets like Vietnam.

Scenario Analysis

Imagine a scenario: If the HIBT token is priced at $100 in the spot market but $110 in the futures market, the basis spread is $10. This spread might suggest strong demand for HIBT in a bullish market. It’s akin to watching a price tag on a rare collectible that appreciates rapidly!

Why It Matters

Grasping the HIBT spot vs futures basis spread is not just for academic purposes; it’s essential for actual trading decisions. For instance, if the futures price significantly exceeds the spot price, it could indicate traders’ expectations of future increases, providing insights into market sentiment.

Conclusion

In conclusion, understanding the dynamics of HIBT spot vs futures basis spread is vital for anyone involved in cryptocurrency trading, especially in fast-paced environments like Vietnam. Staying informed about price differences and the basis spread can lead to better trading outcomes. Always consider local market trends when making decisions.

For additional insights and resources, visit hibt.com to download our latest trading toolkit!