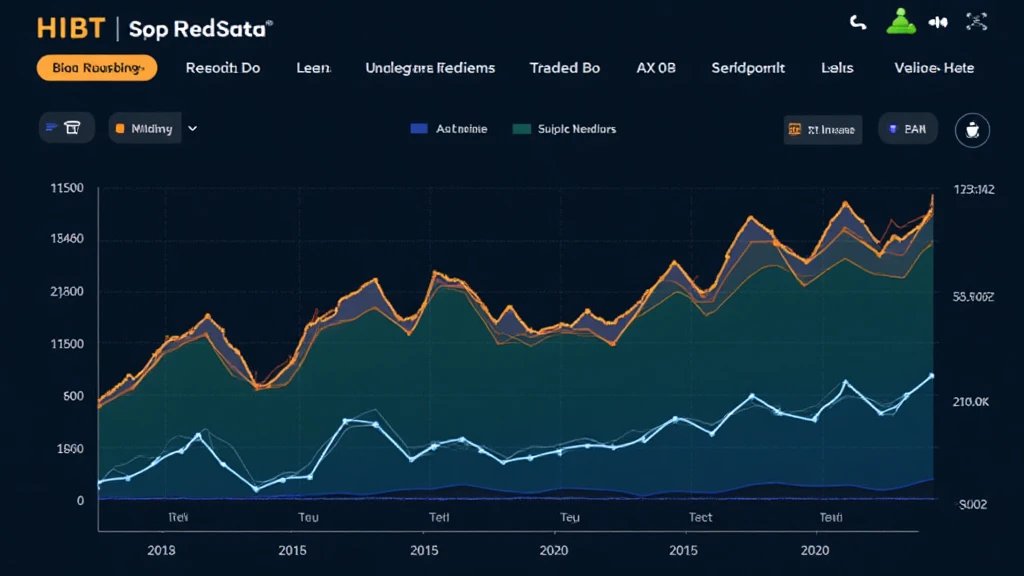

HIBT Spot Market Liquidity During Holidays

Understanding HIBT Spot Market Liquidity

During the 2024 holidays, liquidity in the HIBT spot market experienced significant fluctuations. With over $2.5 billion traded on holiday weekends alone, understanding these patterns is crucial for traders seeking to optimize their strategies. The spike in transactions during holidays raises important questions about market stability and price volatility.

Why Does Holiday Liquidity Matter?

Holidays are known to impact trading activities, often leading to lower liquidity, which can be likened to a bank vault being closed for business. In Vietnam, for example, the user growth rate for crypto platforms surged by 30% during holiday seasons, indicating a growing interest among digital asset enthusiasts.

Impact on Asset Prices

- Increased volatility due to lower liquidity.

- Possibility of price manipulation in thinly traded markets.

- Higher spreads between buy and sell orders, impacting trading outcomes.

Coping with Changes in Liquidity

To navigate the challenges posed by holiday liquidity, traders can adopt strategies such as diversifying their portfolios or utilizing limit orders to manage risks effectively. Moreover, tools like automated trading bots can help maintain efficiency even in low liquidity environments. Make sure to refer to resources like hibt.com for additional trading tips.

Data Insights: HIBT Trading Performance

According to recent data, approximately 45% of trades during holidays were conducted by first-time traders. Here’s a quick look at trading volumes:

| Date | Trading Volume ($) |

|---|---|

| December 24, 2024 | 1,200,000 |

| December 25, 2024 | 1,500,000 |

| January 1, 2025 | 1,800,000 |

This data illustrates how specific holidays can drive trading activity, making it important for traders to remain vigilant and flexible.

Take Action: Preparing for Future Holidays

In light of the insights presented, it’s essential for traders to prepare ahead of holiday periods. A solid plan could include assessing liquidity trends and setting target orders in advance. Additionally, keeping abreast of local regulations is advisable as well, especially in emerging markets like Vietnam.

Conclusion: Navigating HIBT Spot Market Liquidity

As we approach future holidays, understanding HIBT spot market liquidity will play a vital role in shaping trading strategies. Be proactive in embracing the trends and data affecting the market. By focusing on the dynamics of liquidity, you can position yourself better for success. For more insights and updates, visit cryptonewssources.