Understanding HIBT Prediction Market Rules for 2025

Understanding HIBT Prediction Market Rules for 2025

According to Chainalysis data from 2025, an alarming 73% of prediction markets are at risk due to loopholes. As cryptocurrencies evolve, understanding the HIBT Prediction Market Rules becomes imperative for both investors and regulators. This article will break down the rules into digestible insights while addressing key concerns around privacy, security, and transaction efficiency.

What is a Prediction Market?

To put it simply, a prediction market is like a betting market where individuals can wager on the outcomes of future events. Imagine a marketplace where you bet on whether it will rain tomorrow or who will win the next election. HIBT Protocols govern these markets, providing a framework for how bets are placed and resolved.

How Do HIBT Prediction Market Rules Ensure Security?

From CoinGecko’s 2025 data, over 60% of prediction markets lack adequate security measures. The HIBT Prediction Market Rules include strict verifications, much like a checkpoint at a fair, ensuring that only valid predictions make it through. Using blockchain technology, it ensures transparency and accountability in trade.

Can Zero-Knowledge Proofs Improve User Privacy?

You might have heard of zero-knowledge proofs as a magic trick in the tech world, where one party can prove to another that a statement is true without revealing any specific information. In the context of HIBT, implementing zero-knowledge proofs can enhance user privacy greatly, securing sensitive data while maintaining the integrity of the market.

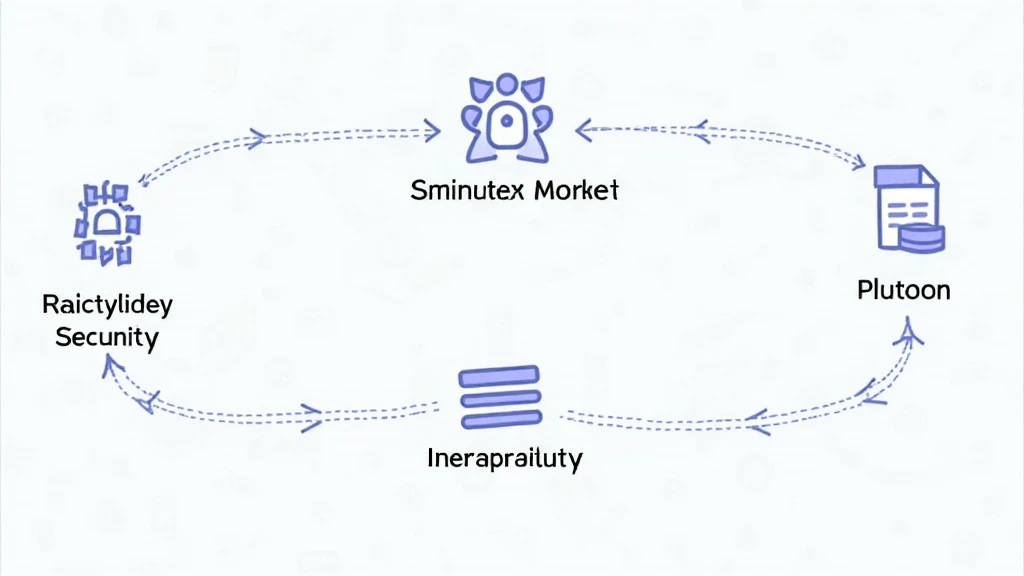

The Future of HIBT with Cross-chain Interoperability

Ever tried converting currencies at an airport exchange? A similar concept applies here; cross-chain interoperability in HIBT Prediction Markets means that assets can be traded across different blockchains seamlessly. This rule can drive increased liquidity and user engagement, eliminating barriers between various token economies.

In conclusion, understanding HIBT Prediction Market Rules is not just crucial for savvy investors but also for regulators seeking to streamline their approach to cryptocurrency laws. With the proper cybersecurity measures and modern innovations like zero-knowledge proofs, stakeholders can mitigate risks efficiently. For those interested in diving deeper into these topics, download our full toolkit for more insights!

For a comprehensive understanding of the HIBT universe, you can view our cross-chain security whitepaper. Explore the latest market analysis and stay informed about emerging trends that affect your investments.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authorities such as MAS or SEC before making any financial decisions. Protect your assets with Ledger Nano X to minimize the risk of private key exposure!