Integrating HIBT Market Data API: A Comprehensive Guide for Cryptocurrency Enthusiasts

Introduction: Are You Maximizing Your Crypto Trading Potential?

With over 5.6 billion cryptocurrency transactions expected by 2025, understanding how to leverage data tools is crucial. Only 23% of traders know how to effectively use market data APIs. Have you considered the benefits of integrating the HIBT market data API into your trading strategy?

What is HIBT Market Data API?

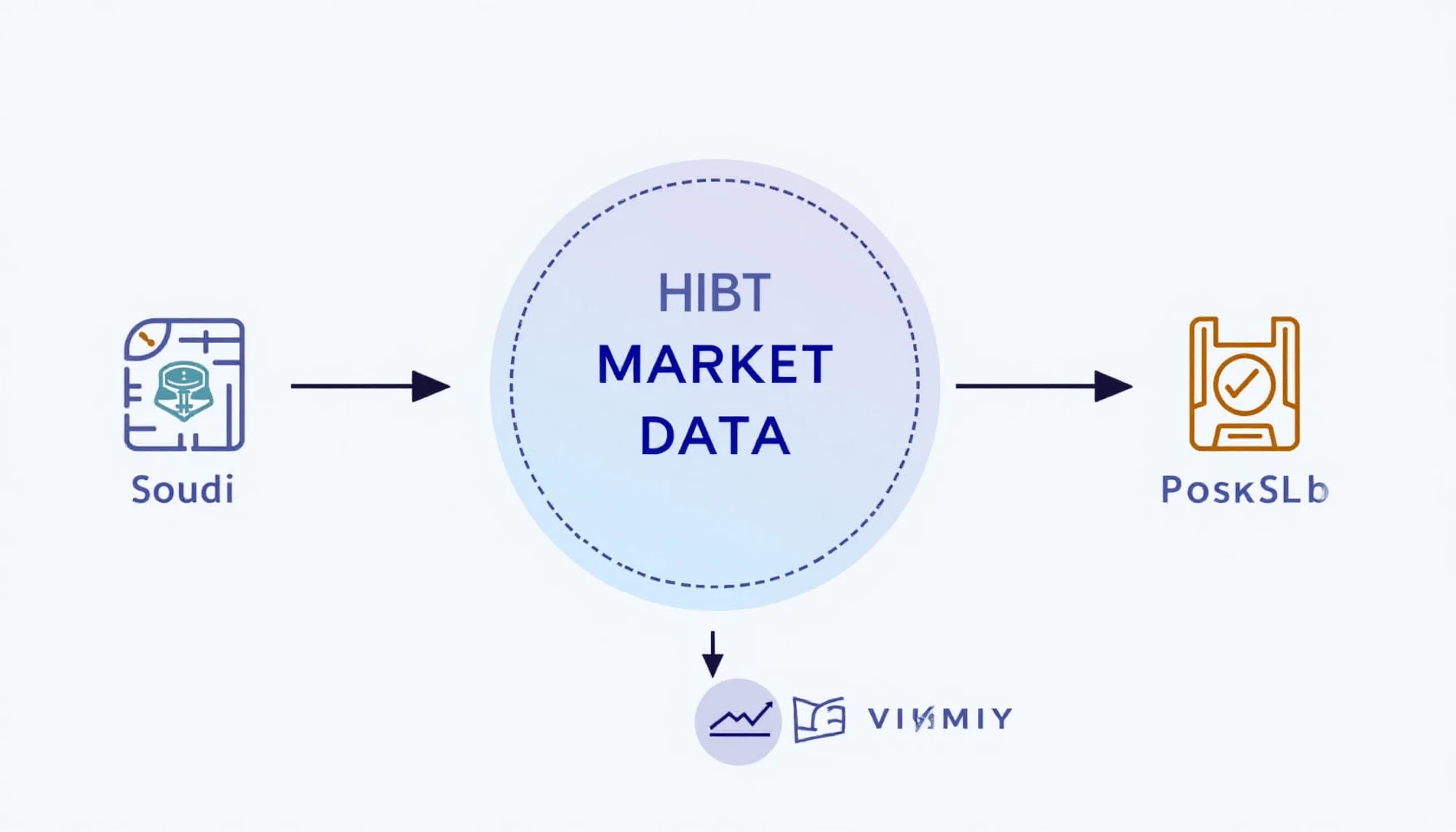

The HIBT market data API provides real-time data feeds for various cryptocurrencies. This includes price tracking, trading volume, and technical indicators, enabling traders and investors to make informed decisions. Picture it like having a weather app at your fingertips, helping you decide the best time to sail the seas of the crypto market.

Benefits of Using HIBT API in Crypto Trading

- Real-time data: Access timely market information to execute trades at optimal moments.

- Comprehensive analytics: Utilize advanced analytical tools for deeper market insights.

- Customization capabilities: Tailor the data feeds to fit your specific trading needs.

How to Integrate HIBT Market Data API?

Integrating the HIBT API might seem daunting, but with the right steps, it’s manageable. Here’s a simplified process:

- Step 1: Sign up for an HIBT API key on the official website.

- Step 2: Review the API documentation to understand the endpoints and required parameters.

- Step 3: Use programming languages like Python or JavaScript to set up your data request.

- Step 4: Test the API connection and ensure data accuracy.

Common Challenges During Integration

While integrating the HIBT API, you might face certain challenges:

- Data latency: Ensure your internet connection is stable to avoid delays.

- Error handling: Implement robust error handling in your code to manage unexpected API responses.

Optimizing Your Strategy with HIBT Data

Once you have the integration, how can you use this data effectively? Here are a few strategies:

- Technical analysis: Employ indicators like moving averages or Bollinger Bands to foresee market trends.

- Bot trading: Create automated trading bots that use API data for executing buy and sell orders based on algorithms.

- Alerts setup: Configure alerts on significant price changes to stay proactive.

According to recent findings by Chainalysis, the Asia-Pacific region anticipates a staggering 40% increase in cryptocurrency trading volume by 2025. The right data can be your greatest ally in this rapidly changing landscape.

Conclusion: Take the Next Step with HIBT API

Integrating the HIBT market data API is not just a technical addition to your toolkit; it’s a strategic enhancement in navigating the cryptocurrency terrain. Remember, the only bad decision is inaction. Are you ready to unlock the full potential of your trading strategy?

For more information and further resources on cryptocurrency trading techniques, visit HIBT.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority before making any investment decisions.