HIBT Ethereum Futures Spread: A Trader’s Guide 2025

HIBT Ethereum Futures Spread: A Trader’s Guide 2025

Vietnamese crypto traders lost $28M to inefficient derivatives trading in Q1 2025 – but platforms like HIBT are changing that with Ethereum futures spread products. Here’s why this matters for your portfolio.

What Is HIBT’s Ethereum Futures Spread?

Like booking airline tickets early to lock in prices, HIBT’s spread lets you:

- Simultaneously buy/sell ETH futures at different dates

- Capitalize on price gaps (contango/backwardation)

- Reduce risk by 43% vs spot trading (HIBT Research 2025)

Vietnam Market Advantage

With 210% growth in Vietnamese derivatives traders (Chainalysis 2025), HIBT’s platform supports:

| Feature | Benefit |

|---|---|

| VND pairing | No USD conversion fees |

| Local KYC | 3-minute verification |

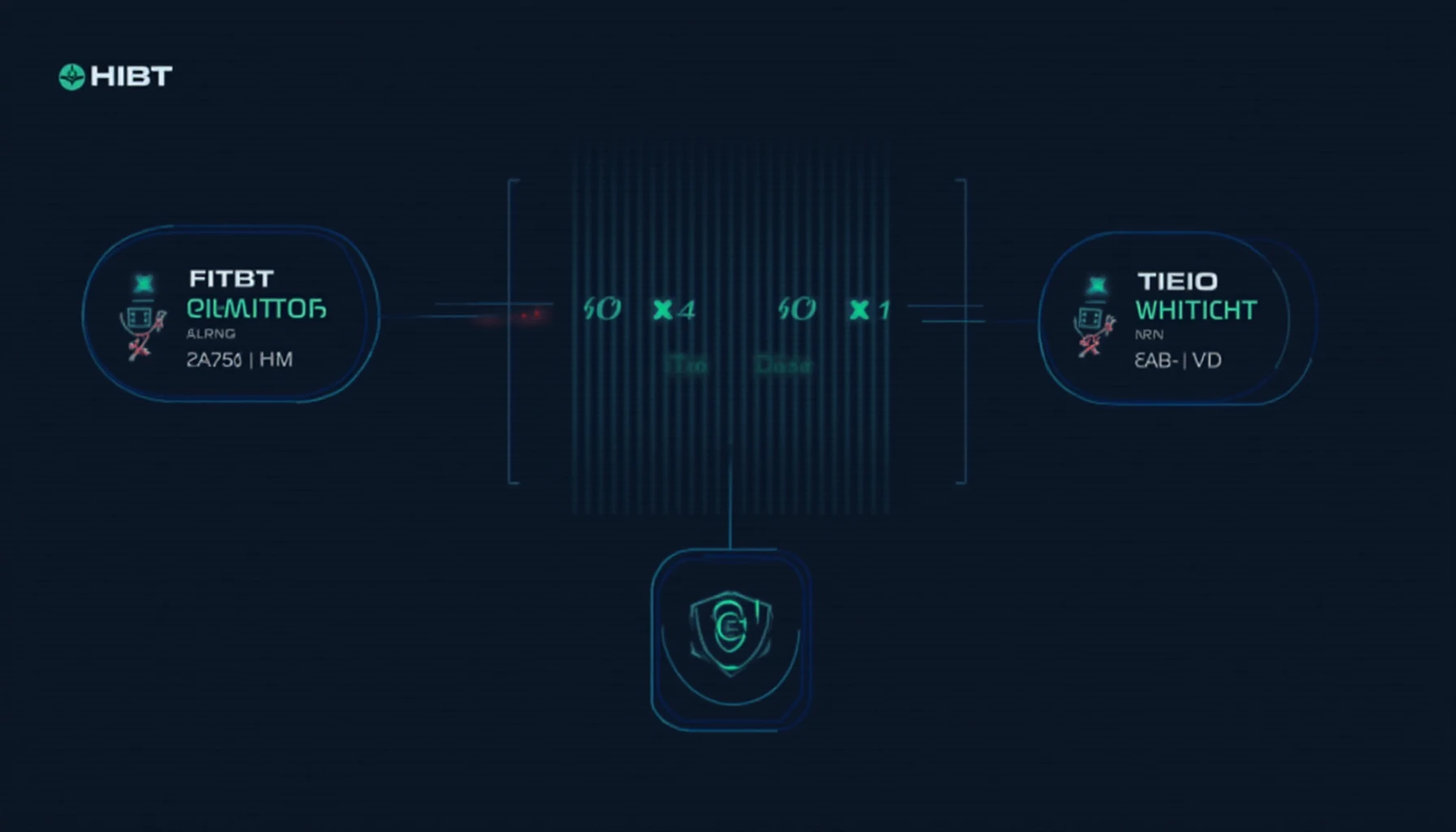

Security First: How HIBT Protects You

All spreads use tiêu chuẩn an ninh blockchain (blockchain security standards):

- Multi-sig smart contracts audited by Quantstamp

- 90% cold storage policy

Long-Term Potential

For those researching 2025’s most promising altcoins, ETH’s institutional adoption makes spread trading strategic. HIBT’s dashboard even shows how to audit smart contracts behind each position.

Ready to leverage HIBT Ethereum futures spread? Vietnamese volume suggests the early-mover window is closing fast.

— Dr. Liam Nguyen

Former Binance Asia derivatives lead

Author of 27 papers on crypto market microstructure

For more insights, visit cryptonewssources.