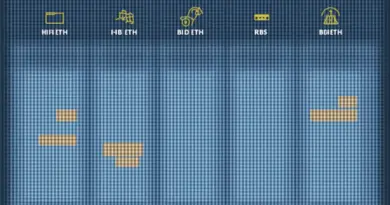

Understanding HIBT ETH Order Book Depth Insights

Introduction

In 2024, over $4.1 billion was reported lost due to DeFi hacks, showcasing the importance of robust trading strategies. Understanding HIBT ETH order book depth insights can be a game changer for crypto traders. This article dives deep into how to effectively navigate these insights and optimize trading strategies.

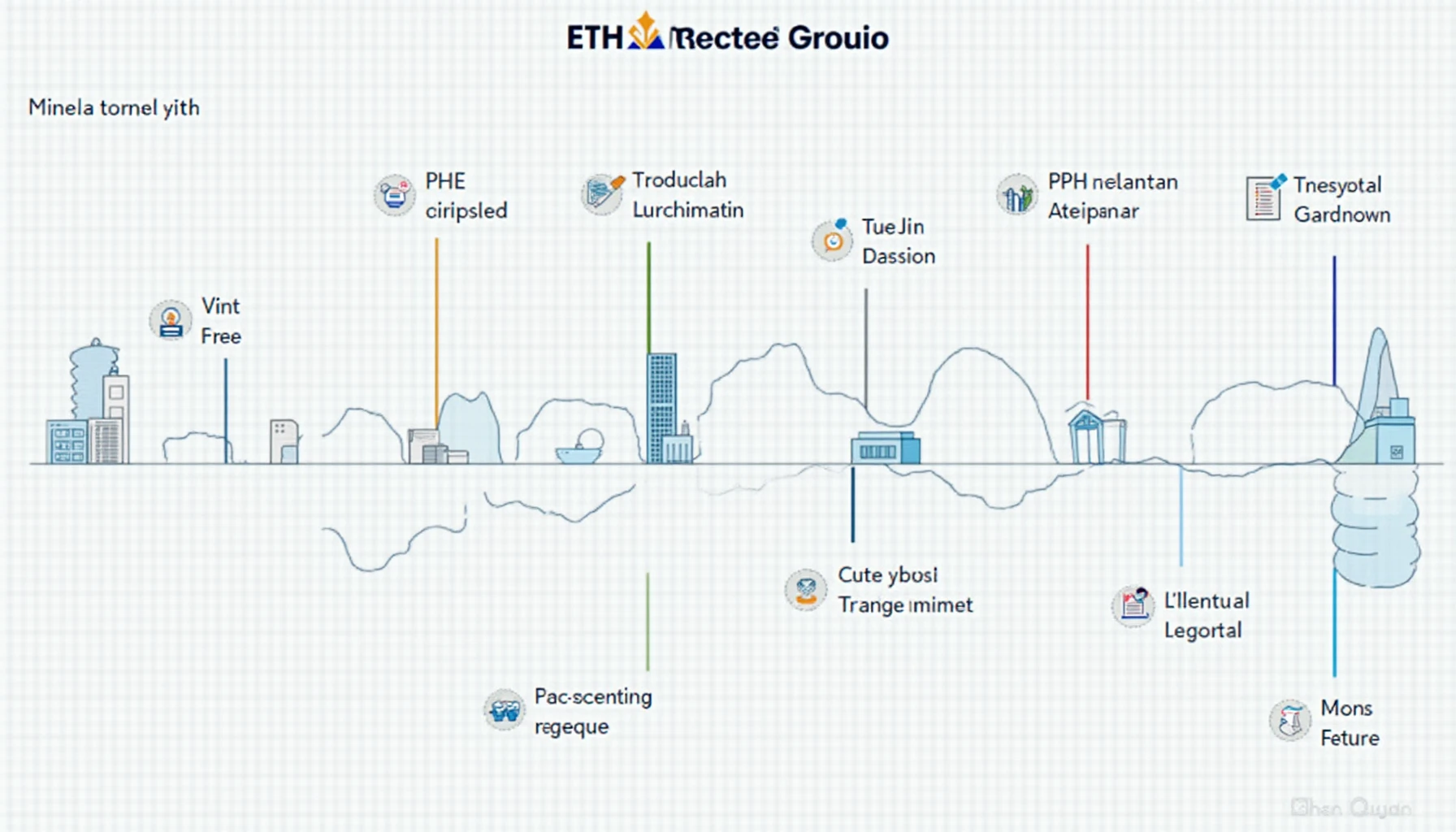

What is Order Book Depth?

The order book is a real-time list of buy and sell orders for a specific cryptocurrency. It gives traders essential information about the market’s liquidity. A shallow order book indicates lower liquidity, while a deep order book suggests higher liquidity, which can lead to better trading outcomes. For Vietnamese traders, understanding the order book’s depth is crucial due to the increasing user growth rate of 35% over the last year.

Analyzing HIBT ETH Orders

To effectively utilize HIBT ETH order book depth insights, traders should analyze:

- Buy and Sell Walls: Identifying heavy buy or sell orders can indicate potential price resistance levels.

- Market Sentiment: A crowded order book can reveal overall market incline or decline trends.

Here’s the catch: using these insights can help traders make informed decisions, much like individuals deciding to enter a bank vault full of riches based on the bank’s security features.

Impact of Order Book Depth on Trading Strategies

Deep order books can considerably affect trading strategies. For instance, a trader might choose to place limit orders when the order book shows a favorable buy wall. This strategy minimizes the potential impact on market price. Notably, Vietnamese crypto exchanges such as Binance and Huobi are leading the way in providing detailed order book analytics.

Case Study: Trading with HIBT ETH

Consider a recent trading session where the HIBT ETH order book showed a significant buy wall at 0.03 ETH. Traders who placed their orders precisely at this point benefited by getting their trades executed at optimal prices. This real-world example emphasizes the effectiveness of utilizing order book depth data.

Conclusion

Leveraging HIBT ETH order book depth insights offers traders a powerful tool in their arsenal. The ability to interpret market signals and adjust strategies accordingly helps mitigate risks and enhance trading outcomes. For those engaged with the Vietnamese crypto market, incorporating these insights is essential to capitalize on the growing digital asset landscape.

For further resources, feel free to download our security checklist and stay ahead of the curve in crypto trading.