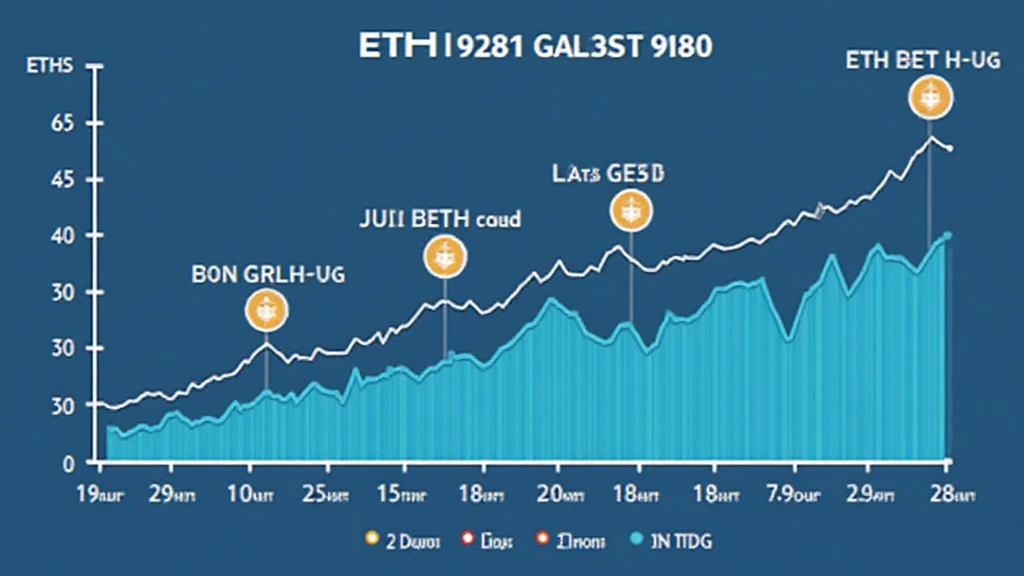

Historical Highs and Lows of ETH Gas Fees

Introduction

As Ethereum continues to evolve, gas fees remain a critical aspect of its ecosystem. With gas costs peaking at an alarming rate of over $70 per transaction in late 2021, many users are left wondering how these fees affect their transactions. In contrast, the fees plummeted to as low as $1.5 in early 2023, showcasing the volatile nature of the Ethereum network.

An Overview of ETH Gas Fees

Gas fees on the Ethereum network are payments made by users to compensate for the computational energy required to process transactions. These costs vary based on network demand. For instance, during times of high activity, gas fees can skyrocket, hindering users, especially in regions like Vietnam where user growth is on the rise, increasing the demand for transactions.

Factors Influencing Gas Fee Fluctuations

- Network Congestion: High transaction volumes lead to increased fees.

- Market Speculation: Price trends in Ethereum can also influence user transaction behavior.

- Layer 2 Solutions: The adoption of Layer 2 protocols like Optimism and Arbitrum aims to reduce gas costs significantly.

The Impact on Users

High gas fees can deter users from participating in the Ethereum network. For example, when fees are at historical highs, users may find it uneconomical to execute smaller transactions. Here’s a scenario: if a user wants to send a mere 0.1 ETH worth $200 but is facing a gas fee of $50, the user might think twice before conducting the transaction.

Conclusion

The historical highs and lows of ETH gas fees illustrate the complexities of the Ethereum ecosystem. Monitoring these fluctuations is essential for users, especially in growing markets like Vietnam, as understanding gas fees can reward them with cost-effective transactions. For more insights and to stay updated, consider visiting hibt.com.