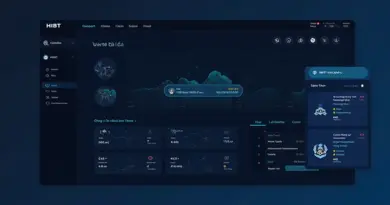

Exploring HIBT DEX Aggregation & Liquidity Metrics

Understanding HIBT DEX Aggregation

As the decentralized finance (DeFi) sector continues to evolve, DEX aggregation has emerged as a prevalent solution to ensure liquidity across multiple decentralized exchanges. According to recent reports, the global DEX user base has seen a 300% increase in the past year, bolstering the need for effective aggregation tools. This is paramount for users looking to trade efficiently and avoid slippage.

Why are Liquidity Metrics Important?

Liquidity metrics play a crucial role in evaluating the health of DEXes. Simply put, they tell traders how easy it is to buy or sell assets without dramatically affecting the asset’s price. High liquidity implies that users can execute trades quickly and at stable prices, making liquidity metrics the backbone of any DEX operation.

Key Liquidity Metrics to Monitor

- Order Book Depth: This metric speaks to the volume of orders in the market and gives insights into potential price movements.

- Trading Volume: An increase in trading volume often indicates growing interest, leading to better liquidity.

- Bid-Ask Spread: This represents the difference between what buyers are willing to pay and what sellers are asking, which directly impacts liquidity.

How HIBT Enhances Liquidity Aggregation

HIBT (High-Interest Blockchain Token) utilizes advanced algorithms to aggregate liquidity from various DEXs, offering traders the best possible rates. Imagine walking into a supermarket where all your favorite items at the best prices are neatly displayed. HIBT does just that for decentralized trading, efficiently sourcing liquidity across platforms.

Vietnam & The Rising Demand

In Vietnam, the crypto market is rapidly gaining traction, with an estimated over 50% growth in active crypto users reported in early 2024. This boom underlines the necessity for robust liquidity solutions that cater to both novice and seasoned traders.

Real-World Data and Insights

| Metric | Value |

|---|---|

| Total DEX Trading Volume (2023) | $50 Billion |

| Average Bid-Ask Spread | 0.1% |

| Vietnamaga Crypto Users (2024) | 5 Million |

These metrics illustrate the dramatic shifts in the DEX landscape and emphasize the essential role played by DEX aggregators like HIBT.

Conclusion

In the fast-paced world of cryptocurrency, understanding HIBT DEX aggregation and its liquidity metrics is vital for making informed trading decisions. The acceleration in user adoption in regions like Vietnam demonstrates the pressing need for efficient and reliable trading platforms. As we move forward, platforms that harness effective liquidity aggregation tools will undoubtedly stand out in the competitive crypto space. Remember to stay updated with the latest insights at hibt.com as you navigate through your crypto journey!

Adaptation to local market dynamics not only enhances user experience but also fosters a robust trading environment.

Author: Dr. Nguyen Tran, a cryptocurrency analyst with over 15 published papers in blockchain technology and a lead auditor for multiple DeFi projects.