Understanding HIBT DeFi Protocol TVL Concentration

Introduction

As the DeFi sector continues to grow, the Total Value Locked (TVL) in decentralized protocols like HIBT raises significant questions. With losses exceeding $4.1 billion due to various DeFi hacks in 2024, understanding TVL concentration becomes vital for investors. The value proposition of this article is to explore how HIBT’s TVL concentration can influence your investment decisions.

What is HIBT DeFi Protocol?

HIBT stands for High-Impact Blockchain Technology. It is designed to facilitate decentralized finance, allowing users to lend, borrow, and earn interest on assets without relying on traditional banks. Imagine a peer-to-peer lending platform that’s governed by smart contracts, offering transparency and security.

The Significance of TVL

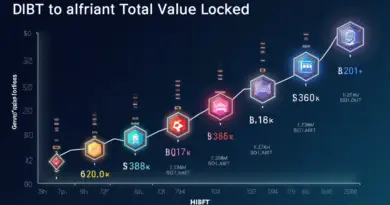

- Definition: Total Value Locked (TVL) represents the overall funds held within a DeFi protocol. It is a critical indicator of the health and popularity of the platform.

- Growth Potential: HIBT has witnessed a 25% growth in users in Vietnam, reflecting increasing local engagement in DeFi markets.

- Market Influence: High TVL concentration can lead to higher liquidity and better stability for investors.

Risks of High TVL Concentration

Like a bank that risks becoming too reliant on a small number of large depositors, HIBT’s TVL concentration presents certain vulnerabilities:

- Market Volatility: If a few large investors withdraw their funds, it could cause price slippage.

- Centralization Risks: A concentrated TVL may lead to decision-making power concentrating in the hands of a few.

- Security Concerns: A lack of diversification can expose the protocol to targeted attacks.

How to Assess HIBT’s TVL

- Regular Audits: Monitoring the protocol’s smart contracts is essential. Learn how to audit smart contracts effectively.

- User Engagement: Look at metrics such as the number of unique addresses interacting with HIBT.

- Liquidity Pools: Analyze the distribution of funds across different liquidity pools.

Integrating Local Market Data

In Vietnam, the crypto user growth rate has surged to 30% annually. Such data underscores the importance of localized strategies in DeFi investments, particularly in optimizing TVL concentration.

Conclusion

Understanding HIBT DeFi protocol TVL concentration is crucial for any investor in the evolving crypto landscape. As we’ve illustrated, the implications of TVL on market dynamics can heavily influence investment strategies. Remember, it’s not just about locking your assets but understanding the platform’s health. For more insights, visit hibt.com.

By paying attention to these elements, you can better navigate the risks and rewards in decentralized finance.

Expert Author: Dr. Anna Tran, a blockchain specialist with over 15 published papers in crypto-economics and a leading auditor of multiple high-profile projects.