Understanding HIBT DeFi Insurance Protocols: The Future of Risk Management in Cryptocurrency

What Are HIBT DeFi Insurance Protocols?

Have you ever considered the risks involved in the rapidly evolving world of cryptocurrency? With over 5.6 billion cryptocurrency transactions taking place globally, the need for reliable insurance solutions has never been greater. HIBT DeFi insurance protocols are designed specifically to address these concerns.

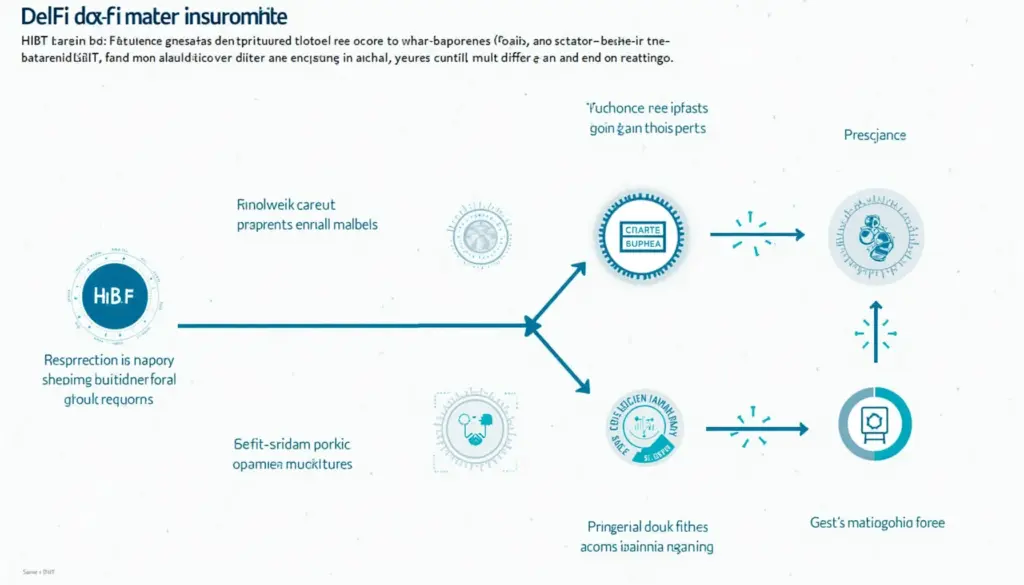

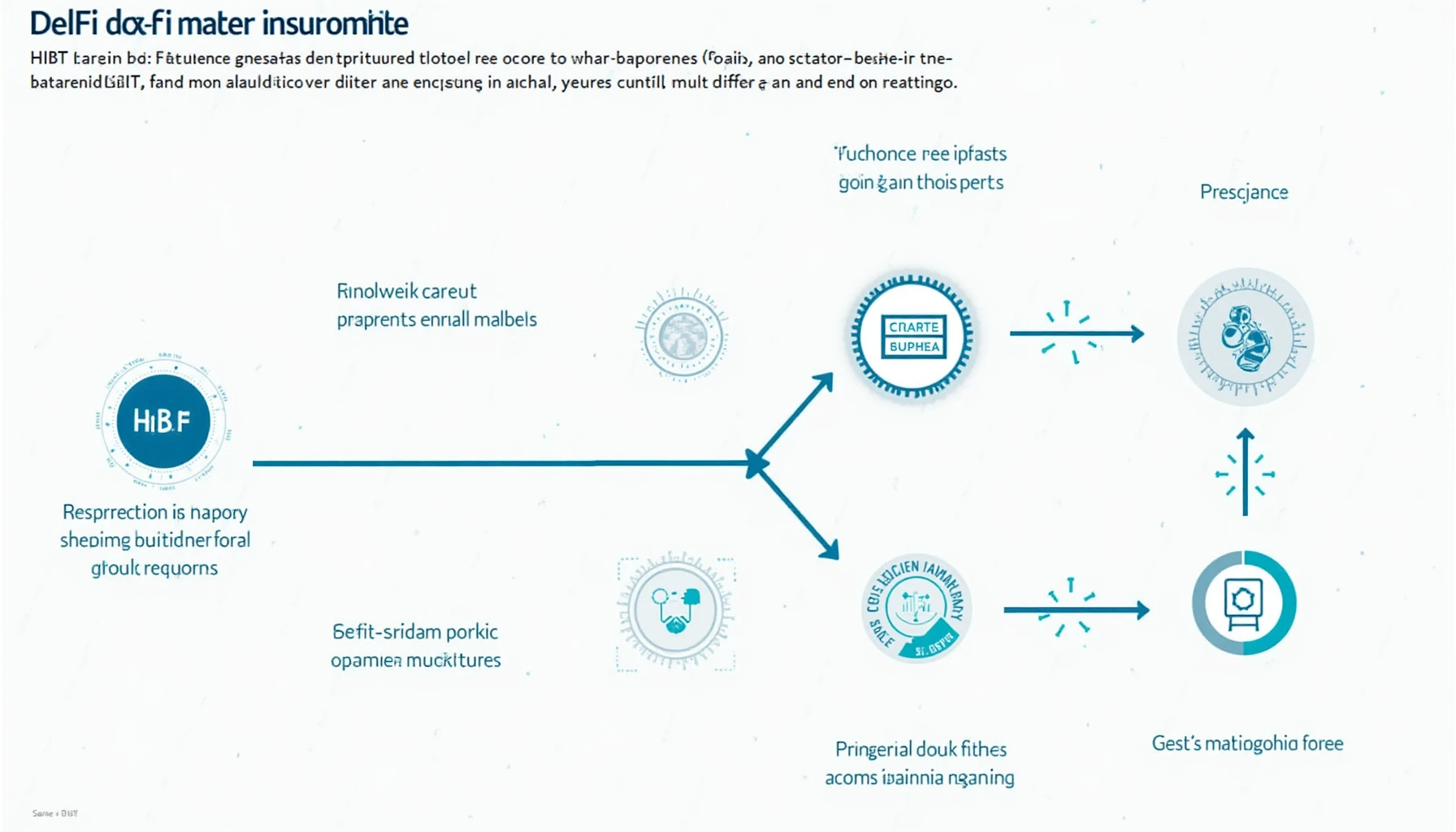

How Do HIBT DeFi Insurance Protocols Work?

Imagine a farmer insuring his crops against floods or drought. In a similar way, HIBT DeFi insurance protocols enable users to protect their assets against unpredictable market fluctuations. These protocols operate on blockchain technology, ensuring transparency and security. Here’s how:

- Smart Contracts: Automated contracts execute insurance claims when predefined conditions are met.

- Decentralized Risk Pooling: Users contribute to a shared risk pool, providing coverage to each other.

- Tokenized Insurance: Insurance policies are represented as tokens, tradable on various platforms.

Why Are HIBT DeFi Insurance Protocols Important?

With traditional insurance often being slow and bureaucratic, HIBT DeFi protocols offer a faster, more efficient solution. Consider that only 23% of crypto holders understand how to secure their assets properly. This gap presents a hefty opportunity for innovative insurance solutions. By providing immediate coverage options, these protocols improve investor confidence.

The Future of Insurance in the Cryptocurrency Space

As we move towards 2025, we can expect a surge in the adoption of HIBT DeFi insurance protocols. According to a recent Chainanalysis report, the Asia-Pacific region is projected to see a 40% increase in DeFi activity. As more users enter the market, the need for reliable insurance products will become crucial.

How to Get Started with DeFi Insurance

Getting involved with HIBT DeFi insurance protocols is easier than you might think. Here’s a simple guide to start your journey:

- Research popular protocols that align with your investment goals.

- Ensure you understand the insurance coverage conditions.

- Invest in reputable platforms with a strong track record.

Remember, this article doesn’t constitute investment advice. Always perform due diligence and consult local regulatory bodies before making any financial decisions.

Conclusion: Take Action Now!

As the cryptocurrency landscape continues to evolve, integrating HIBT DeFi insurance protocols can be a game-changer for crypto investors. Understanding these protocols not only helps in managing risks but also positions you for success in a burgeoning market. Ready to dive deeper into the world of DeFi insurance? Visit HIBT for more resources. Remember, being informed is your best strategy!