HIBT Crypto Tax Reporting Accuracy

Introduction

As the popularity of cryptocurrencies rises, particularly in regions like Vietnam, where the user growth rate has surged by 32% in the past year, accurate crypto tax reporting has become a pressing concern. In 2024 alone, $4.1 billion was lost to DeFi hacks, highlighting the importance of precise financial practices. This article will outline how HIBT can revolutionize your crypto tax reporting, ensuring compliance and minimizing liabilities.

Understanding Crypto Tax Reporting

Crypto tax reporting involves the declaration of digital asset earnings and losses to comply with local regulations. Yet, many cryptocurrency users often struggle with this reporting due to the complexities involved. It’s critical, especially for vibrant markets like Vietnam, to adopt tools that streamline this process.

Why Choose HIBT?

HIBT stands out as a reliable solution for crypto tax reporting accuracy. Here’s what makes it unique:

- Automated Calculations: HIBT uses sophisticated algorithms to calculate your crypto taxes accurately.

- Comprehensive Records: Maintain thorough records of every transaction, ensuring you can present accurate figures to local authorities.

- Real-Time Updates: As tax regulations evolve, HIBT promptly reflects changes, helping users stay compliant.

Maximizing Tax Efficiency

Having accurate tax reporting can directly affect your financial health. Here’s how to maximize tax efficiency with HIBT:

1. Track Gains and Losses

Utilize HIBT’s tracking features to monitor your investments. Just like securing valuables in a bank vault, HIBT protects your tax information efficiently.

2. Utilize Tax-Loss Harvesting

This strategy involves offsetting taxable gains with losses. HIBT can automatically identify opportunities for tax-loss harvesting, ensuring you optimize your tax outcome.

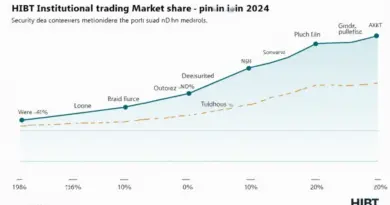

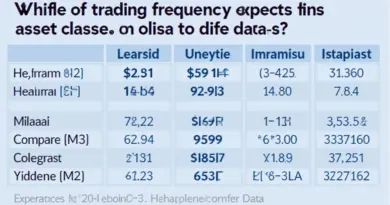

Real Data Insights

Below is a summary of key insights regarding crypto users in Vietnam:

| Year | User Growth Rate (%) | Losses Due to Hacks ($B) |

|---|---|---|

| 2021 | 15 | 2.1 |

| 2022 | 25 | 3.0 |

| 2023 | 32 | 4.1 |

Source: Chainalysis Report 2025

Conclusion

In conclusion, HIBT plays a critical role in ensuring crypto tax reporting accuracy, particularly in a fast-evolving market like Vietnam. With tools that simplify complex calculations and ensure compliance, users can focus on growing their investments rather than worrying about tax liabilities.

For further insights into crypto tax obligations, download our security checklist and stay informed.