Understanding HIBT Crypto Loan Interest Rate Spread

Understanding HIBT Crypto Loan Interest Rate Spread

With the surge in blockchain technology, interest in crypto loans has skyrocketed, leading to a complex landscape regarding HIBT crypto loan interest rate spread. This rising trend poses intriguing questions for both investors and borrowers, especially in markets like Vietnam where the growth rate of cryptocurrency users has reached an impressive 350% in the past year.

The Basics of HIBT Crypto Loans

HIBT crypto loans allow users to borrow against their digital assets, similar to securing a loan with collateral in traditional banks. Here’s the catch: the interest rate spread significantly impacts both the lender’s earnings and the borrower’s costs.

What is Interest Rate Spread?

The interest rate spread is the difference between the interest rate lenders charge borrowers and the interest rate offered to their own depositors. For example, if a platform charges borrowers 8% but pays depositors 3%, the spread is 5%. With the increasing adoption of crypto loans, understanding this spread becomes essential for informed decisions.

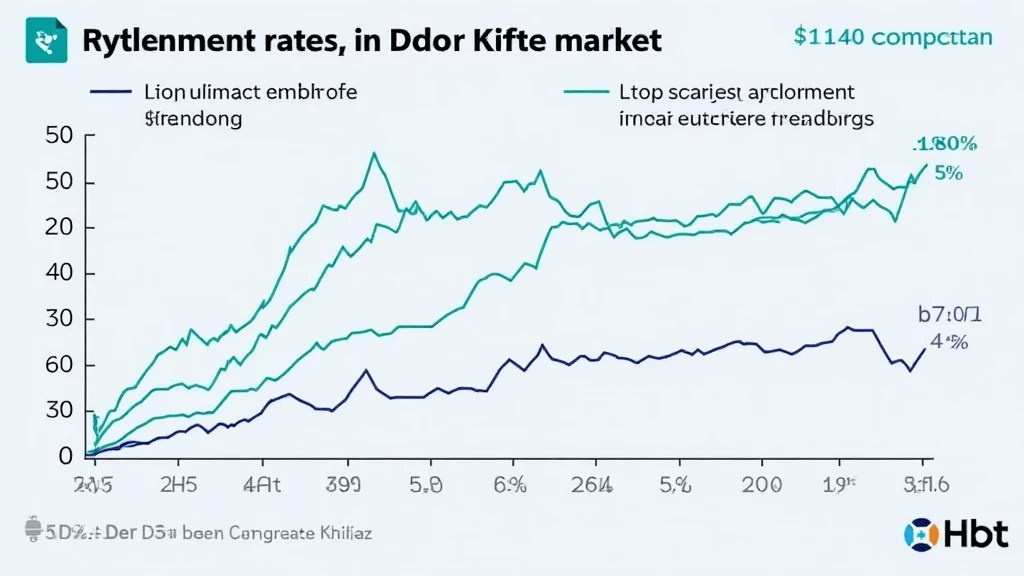

Market Trends Influencing HIBT Rates

As per HIBT.com, the overall market conditions and regulatory developments shape the crypto loan interest rate spread. In Vietnam, the local market is becoming a hub for digital assets, resulting in tighter spreads due to heightened competition among platforms to attract users.

Volatility and Risk Factors

- Market Volatility: Crypto assets are subject to rapid changes in value, impacting loan security.

- Regulatory Environment: Changes in Vietnamese crypto regulations can influence interest rates.

- Loan-to-Value (LTV) Ratios: Greater LTV ratios typically increase the interest rate spread.

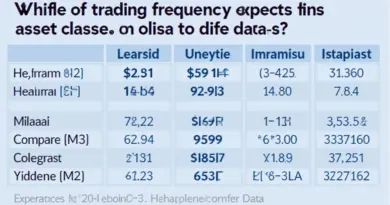

Comparing Rates Across Platforms

Different crypto platforms present varying interest rates, influenced by their liquidity, governance, and user base. Comparing these rates helps potential borrowers make cost-effective choices. For instance, a table comparing rates may look like this:

| Platform | Interest Rate | Borrowing Spread |

|---|---|---|

| Platform A | 8% | 5% |

| Platform B | 7% | 4% |

Conclusion

Understanding the HIBT crypto loan interest rate spread is vital for making sound financial decisions in the growing crypto economy. As Vietnam witnesses rapid growth in user adoption, borrowers need to be savvy about their options. Platforms adjusting their spreads can either be a boon or a burden, depending on how well they manage risk and user demand.

Always consult with financial advisors and local regulators, as these insights are not financial advice. For more information on the best practices around borrowing in the crypto space, visit HIBT.com today.