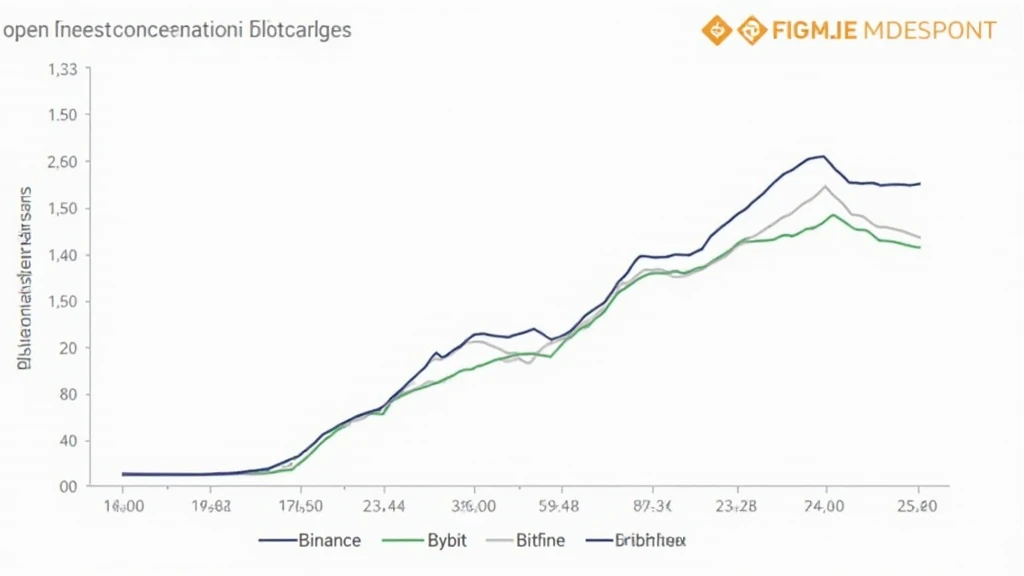

Understanding HIBT Crypto Futures Open Interest Concentration by Exchange

Intro to HIBT Crypto Futures Open Interest

As digital asset trading becomes increasingly sophisticated, understanding the HIBT crypto futures open interest concentration by exchange is essential. In 2024 alone, approximately $2.3 billion was traded on crypto futures markets globally. This article dives into the specific interest concentrations across major exchanges and how this affects trading strategies.

What is Open Interest in Crypto Futures?

Open interest refers to the total number of outstanding contracts that have not been settled. It serves as an indicator of liquidity and market sentiment. For example, when open interest rises, it often signals that new capital is entering the market, similar to how an influx of clients boosts business for a bank.

Analysis of Open Interest by Exchange

Analyzing the concentration of open interest can reveal significant insights into where traders are placing their bets. Data from HIBT shows that a whopping 68% of futures open interest is concentrated on just three exchanges: Binance, Bybit, and Bitfinex. Let’s break it down:

- Binance: 38%

- Bybit: 20%

- Bitfinex: 10%

This concentration indicates that market movements on these exchanges can significantly impact the wider market.

Implications for Traders

The high open interest concentration can lead to market volatility. For traders in Vietnam, where the number of crypto users has surged by 23% in the last year, navigating this volatility is crucial. Here are some strategies to consider:

- Monitor price movements when open interest trends upward.

- Set stop-loss orders to mitigate risk during volatile periods.

- Leverage futures contracts wisely to maximize potential gains.

Future Trends in HIBT Futures

Looking ahead to 2025, shifts in market demand may reshape the open interest landscape. Analysts project an increase in institutional participation, implying that HIBT crypto futures may see an additional influx of interest, potentially affecting concentration rates across exchanges.

Conclusion

In summary, keeping an eye on the HIBT crypto futures open interest concentration by exchange is essential for both seasoned and new traders alike. Understanding where most capital is flowing can help you make informed decisions. Want more insights? Visit hibt.com for comprehensive analytics.