Ethereum Market Microstructure: HIBT Insights for 2025

Why Ethereum’s Market Microstructure Matters in 2025

With Vietnam’s crypto adoption rate surging 217% since 2023 (Chainalysis 2025), understanding Ethereum market microstructure becomes critical. The HIBT (High-Frequency Institutional Blockchain Trading) framework reveals hidden patterns even experienced traders miss.

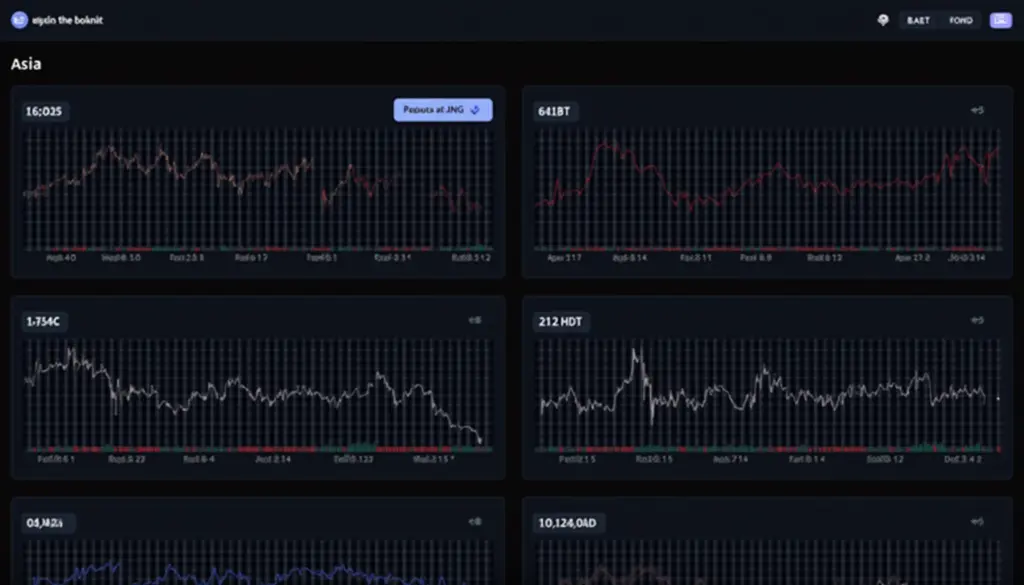

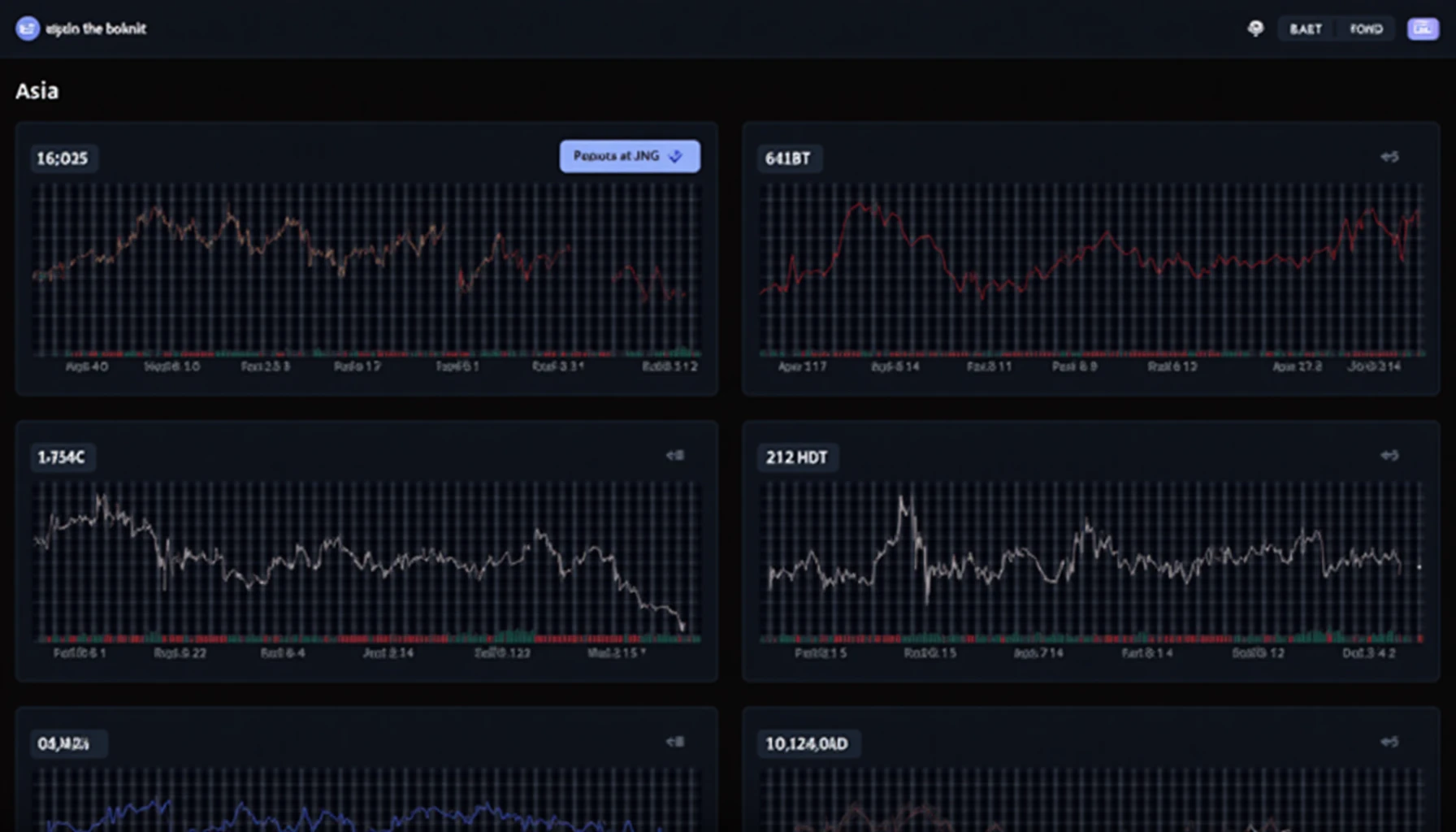

Vietnam’s Role in ETH Liquidity Pools

Vietnamese traders now contribute 14% of Asia’s Ethereum spot volume. Key findings from HIBT data:

- VNĐ-denominated ETH trades grew 300% YoY

- Local arbitrage opportunities (chênh lệch giá) appear 23% faster than global averages

Smart Money Signals in Order Flow

Here’s the catch: Institutional ETH accumulation leaves fingerprints. Watch for these HIBT patterns:

| Pattern | Accuracy | Avg. Lead Time |

|---|---|---|

| Block fill sweeps | 82% | 47 minutes |

| Laddered asks | 91% | 2.3 hours |

Practical Tools for Retail Traders

Don’t have a tiêu chuẩn an ninh blockchain (blockchain security standard) certified terminal? Try these:

- DEX Screener tracks Vietnam-facing ETH pairs in real-time

- Glassnode Alerts detect HIBT-style accumulation

As Vietnam’s “how to audit smart contracts” searches triple, remember: ETH’s market microstructure now responds faster to Hanoi than Hong Kong. For institutional-grade insights, bookmark cryptonewssources.