Understanding Ethereum Market Microstructure

Understanding Ethereum Market Microstructure

With over $30 billion traded daily on Ethereum platforms, understanding the Ethereum market microstructure is essential for traders and investors alike. The intricacies of this market play a critical role in decision-making processes and investment strategies.

What is Market Microstructure?

Market microstructure involves the mechanisms and processes that facilitate trading in financial markets. It encompasses everything from order types to market participant behaviors. On Ethereum, this is particularly relevant since it’s one of the leading platforms for decentralized finance (DeFi).

Components of Ethereum Market Microstructure

- Order Types: Limit orders, market orders, and stop orders each serve unique purposes and can affect market prices differently.

- Liquidity Providers: Entities that facilitate trading by offering buy and sell orders can significantly impact the market’s depth and volatility.

- Slippage: In volatile markets, the price at which a trade executes may differ from the expected price, affecting profitability.

The Role of Liquidity in Trading

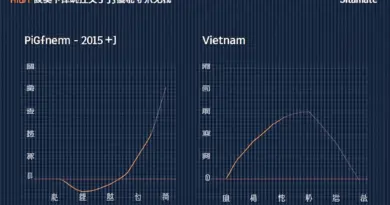

Liquidity is crucial in the Ethereum market microstructure. High liquidity typically leads to tighter spreads and less slippage. For instance, Vietnam’s Ethereum user growth rate has surged by 25% year-on-year, indicating increasing trading activity. This growth can enhance liquidity, benefiting traders by reducing costs.

Impact of Market Dynamics

Understanding the behavioral patterns of traders on Ethereum can be likened to navigating a bustling market — timing and strategy matter. Factors such as the influence of large trades, or “whales,” can also create substantial price movements.

Strategies for Effective Trading

When engaging with the Ethereum market, consider these strategies:

- Technical Analysis: Utilize charts and historical data to inform your trading decisions.

- Arbitrage Opportunities: Look for price discrepancies across different exchanges.

- Smart Contract Auditing: Understanding how to audit contracts can safeguard investments and enhance your overall strategy. (For more on this, see our article on how to audit smart contracts.)

Future Outlook: The Evolution of Ethereum Markets

As Ethereum continues to evolve, the microstructure dynamics will also change. Innovations in DeFi protocols could lead to entirely new trading experiences. According to Chainalysis, the market is expected to grow substantially in 2025, presenting both opportunities and challenges for investors.

Conclusion

Grasping the nuances of the Ethereum market microstructure can drastically improve your investment or trading strategy. As the landscape evolves, staying informed and adaptable is key.

Remember, this is not financial advice. Always consult local regulators and do your own research.

For further insights into the crypto world, visit cryptonewssources.