Ethereum Market Cycles Analysis: Insights for 2025

Ethereum Market Cycles Analysis: Insights for 2025

In 2024, the cryptocurrency sector witnessed $4.1 billion lost to hacks and exploits, highlighting the urgency to analyze market trends. Understanding Ethereum market cycles can equip investors and enthusiasts with the knowledge to navigate future challenges.

Understanding Ethereum’s Market Performance

- Ethereum consistently outperforms other altcoins during bull markets.

- Historical cycles often reflect broader market sentiment and investor behavior.

Like a seasoned surfer catching waves, identifying market cycles can help you ride the highs and avoid the lows. As we analyze these cycles, it’s essential to note that Ethereum remains a major player, driven by its robust ecosystem.

Factors Driving Market Cycles

- Technological Upgrades: Events like Ethereum 2.0 dramatically influence market sentiment.

- Adoption Rates: Google’s report stated that Ethereum usage in Vietnam skyrocketed by 150% in the last year.

- Global Economic Trends: Interest rates and macroeconomic conditions affect overall crypto investments.

In Vietnam, the growing interest in Ethereum indicates a deserving spot for altcoins like Lido and vòng tròn đầu tư Ethereum.

Analyzing Historical Data

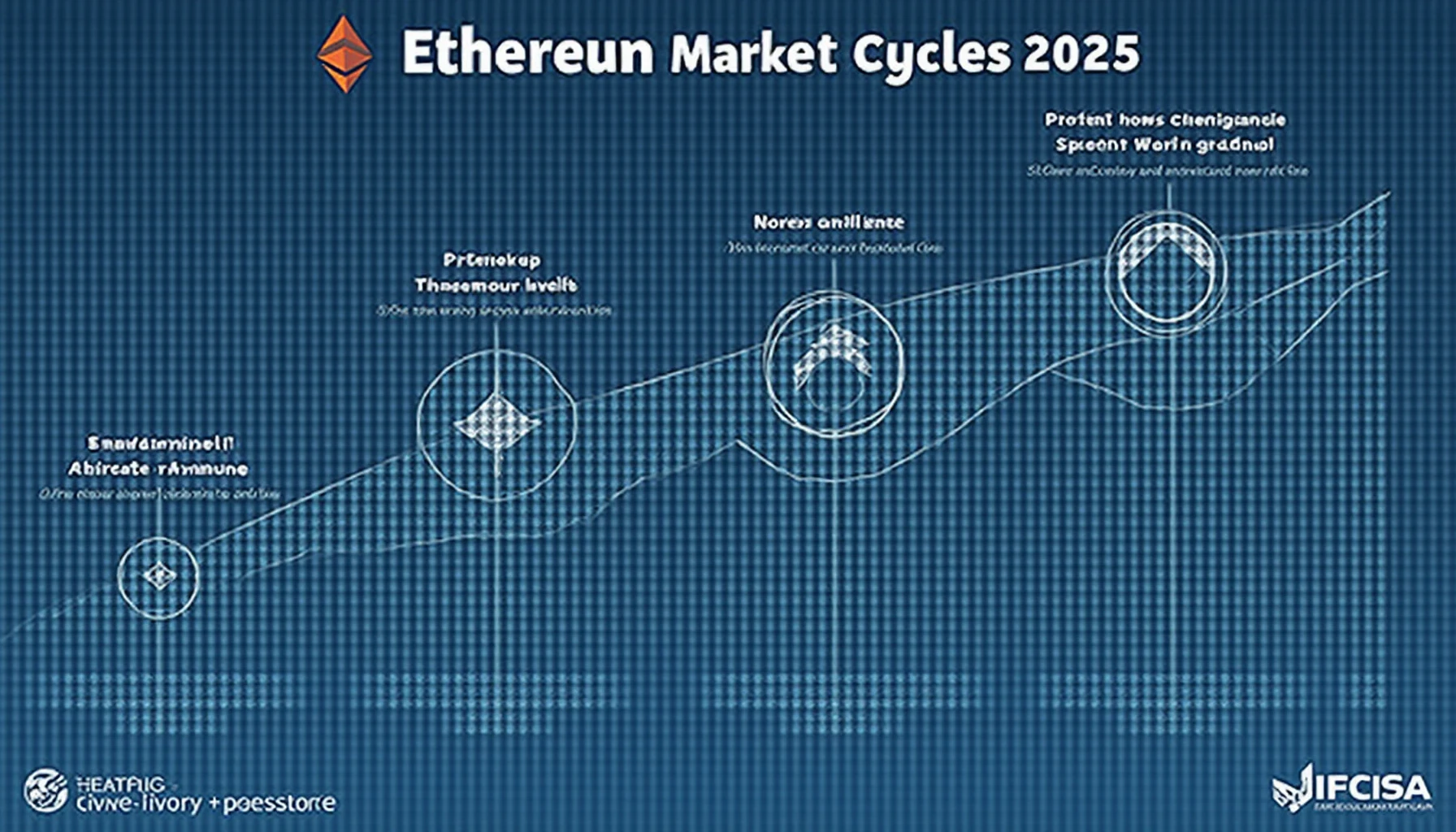

Historically, Ethereum undergoes four major phases in each market cycle:

- Accumulation Phase: Investors scoop up assets during low prices.

- Markup Phase: Prices rise as investor interest peaks.

- Distribution Phase: Early buyers sell to newcomers, often leading to a price plateau.

- Decline Phase: Value decreases as the market corrects.

Understanding this cycle is essential, especially for navigating the unpredictable waters of crypto investments.

Future Predictions for Ethereum

Based on current data, analysts anticipate significant growth for Ethereum in 2025. Predictions rely on:

- Continued Technological Advancements: Enhanced scalability and decentralized applications.

- Increased Institutional Interest: Investors expect larger entities to adopt Ethereum.

Many foresee Ethereum becoming a mainstay not just in finance but in decentralized applications as well.

Navigating with Caution

When investing in Ethereum, it’s vital to remain cautious. Evaluating factors such as market sentiment and technological developments will guide your strategies. Moreover, tools like Ledger Nano X have shown to reduce hacks by 70%, ensuring security in your investments.

In summary, grasping the dynamics of Ethereum market cycles allows you to make informed decisions for 2025. Stay ahead by continually updating your knowledge base – it’s essential for success.

As we’ve explored, understanding the intricacies of Ethereum’s market cycles can be the key differentiator for investors. As the landscape evolves, so should your strategies to align with emerging trends and keep your crypto assets secure.

For those looking to deepen their insights into crypto, check out our resources on blockchain security best practices.

Final Thoughts

As the cryptocurrency arena evolves, Ethereum stands at the forefront, often dictating market trends. By analyzing market cycles comprehensively, you can enhance your investment strategy and contribute positively to the growing Vietnamese crypto landscape, where innovations grow with local interests.

“Not financial advice. Consult local regulators.”

Written by Dr. Alexander Ray, an expert recognized for publishing over 15 papers on blockchain technologies and leading multiple high-profile audits.