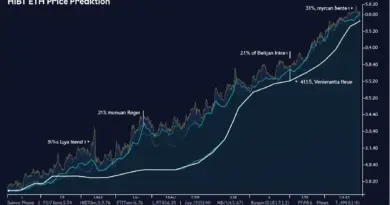

Ethereum DeFi Flash Loans on HIBT: A Smart Move?

Introduction

With $4.1 billion lost to DeFi hacks in 2024, understanding security in decentralized finance is more crucial than ever. Flash loans, particularly on platforms like HIBT, represent a unique opportunity to leverage Ethereum’s capabilities while minimizing risk. But what exactly are flash loans, and how can they be securely utilized?

What are Ethereum DeFi Flash Loans?

Flash loans are uncollateralized loans that allow users to borrow funds without upfront collateral, provided they pay it back within the same transaction block. This model, championed by Ethereum’s DeFi ecosystem, opens the door for arbitrage and other lucrative opportunities, yet it carries its own risks.

The Mechanics of Flash Loans

- Borrow funds instantly without collateral

- Execute trades or transactions within a single transaction block

- Return borrowed funds with a fee

Imagine a scenario similar to a bank transaction: like a vault that opens just for a moment, allowing quick access to funds before they close again.

Why HIBT for Flash Loans?

HIBT has emerged as a leading platform for facilitating flash loans, boasting features that enhance security and efficiency:

- Low fees: Competitive transaction costs attract more users.

- High liquidity: Ensures that users can quickly execute trades.

- User-friendly interface: Simplifies the process for beginners.

These features make HIBT an attractive option, especially amid a rapidly growing Vietnamese user base, which saw a growth rate of 30% in 2024.

Risks Involved in Flash Loans

Utilizing Ethereum DeFi flash loans on HIBT is not without risk.

- Smart contract vulnerabilities: Always a concern in DeFi.

- Market volatility: Rapid price changes can impact transaction outcomes.

- Potential for liquidation: If loans are not repaid, assets can be at risk.

It’s essential to conduct thorough due diligence and, perhaps, consult resources such as HIBT to ensure you mitigate these risks effectively.

How to Engage Safely in Flash Loans

To safely engage with flash loans on HIBT:

- Audit smart contracts to validate security protocols.

- Stay updated on platform changes and community feedback.

- Use tools like HIBT’s security checklist for best practices.

Engaging with the right tools and knowledge can make a significant difference in your DeFi experience.

Conclusion

As the Ethereum ecosystem continues to evolve, DeFi flash loans on HIBT represent a promising frontier. With careful strategies and security measures, they can enhance financial opportunities. Stay informed, engage actively, and don’t hesitate to explore what HIBT offers. That could mean pioneering into the future of finance.

For more insights into decentralized finance and blockchain security, visit cryptonewssources.

About the Author: Dr. Anna Nguyen is a blockchain consultant and has authored over 10 papers on DeFi security. She has led audits on several high-profile projects in the industry, making her an authority on cryptocurrency and smart contracts.