Understanding Crypto Token Taxonomy: A Comprehensive Guide

What is Crypto Token Taxonomy?

The concept of crypto token taxonomy refers to the classification system used to understand the different types of tokens available in the market. With over 5.6 million cryptocurrency holders globally, understanding this taxonomy is crucial for effective digital currency trading and investment.

The Different Types of Tokens Explained

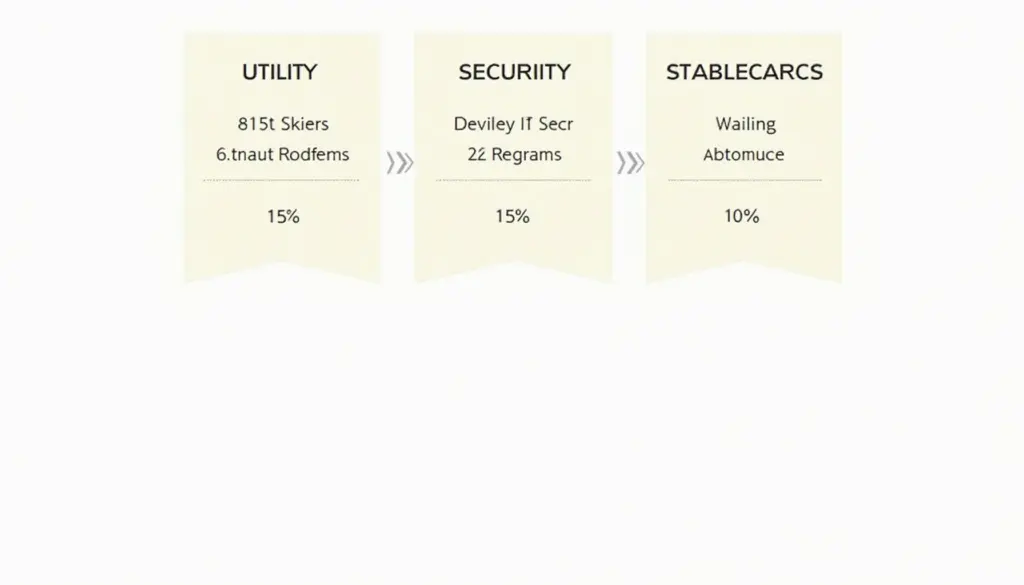

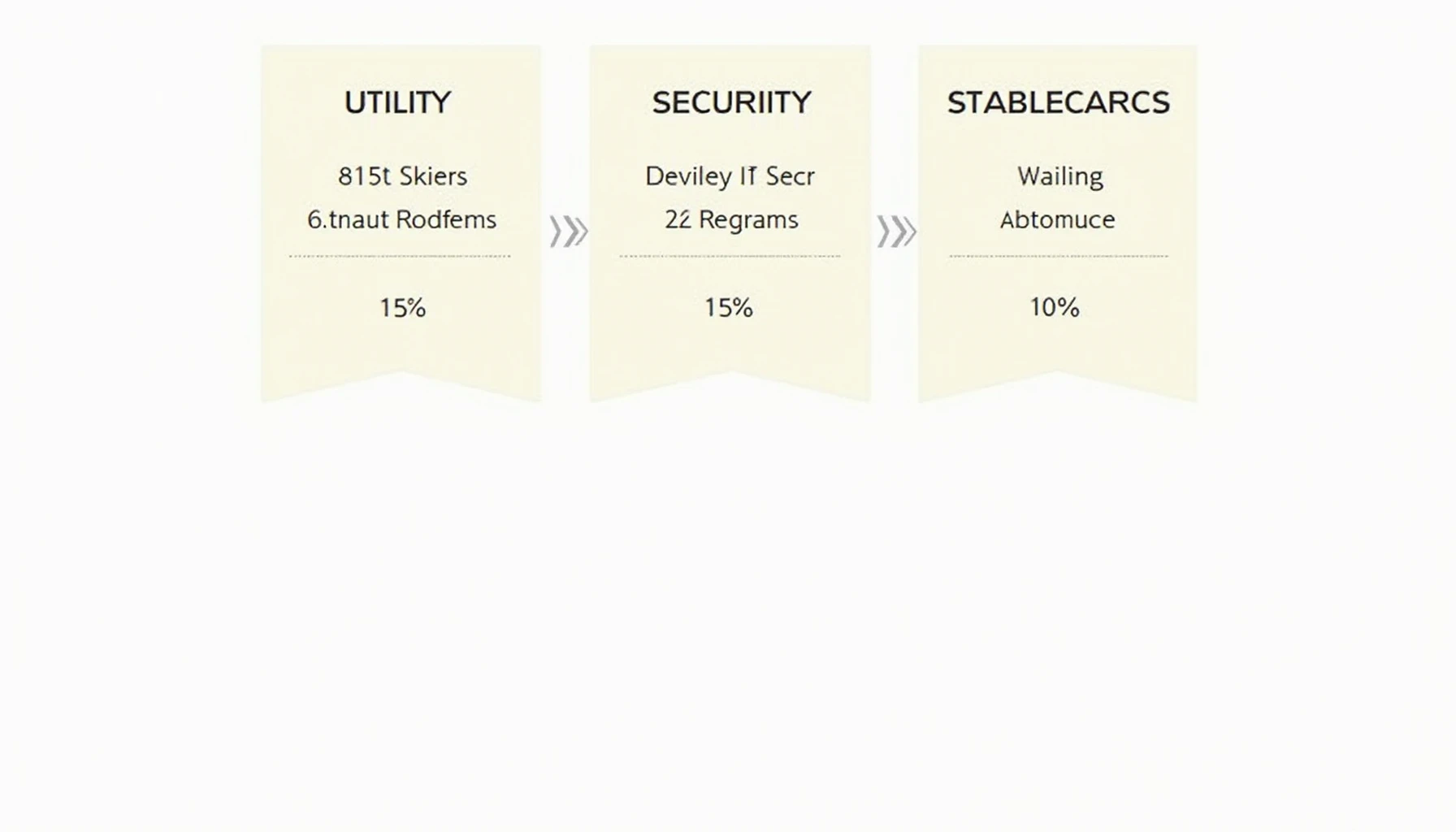

Tokens can be classified into several categories based on their functionalities:

- Utility Tokens: These tokens provide users with access to a product or service. A common example is Binance Coin, which can be used to pay for trading fees.

- Security Tokens: Represent ownership in an asset or a share of a company. These are subject to federal regulations, similar to traditional stocks.

- Stablecoins: Cryptocurrencies pegged to stable assets like the US dollar to minimize volatility, making them ideal for transactions.

Why is Token Taxonomy Important for Investors?

Understanding token taxonomy helps investors identify potential investment opportunities and risks, especially as the landscape continues to evolve. According to a 2025 report by Chainanalysis, the Asia-Pacific region alone is expected to see a 40% increase in trading volume.

Secure Storage of Crypto Tokens

Investors often ask, “How can I safely store my cryptocurrency?” Here are some best practices:

- Use Hardware Wallets: Devices like Ledger Nano X significantly reduce the risk of hacking.

- Enable 2-Factor Authentication: Adding an extra layer of security is essential.

- Regularly Update Software: Keeping your wallets updated helps protect against vulnerabilities.

Conclusion: Stay Informed and Secure

In conclusion, understanding crypto token taxonomy is vital for successful engagement in digital currency trading and investment. As the market continues to mature, staying informed and adopting secure storage practices can make all the difference.

For more insights, consider reading our articles on crypto security tips and latest altcoins trends. Remember, this article does not constitute investment advice; please consult local regulatory authorities before making any decisions.