Optimize Your Crypto Taxes with Crypto Tax Calculators

Pain Points in Crypto Tax Reporting

In the ever-evolving landscape of cryptocurrency, many investors face a daunting challenge—accurately reporting their taxes on crypto transactions. With the IRS tightening its grip on crypto taxation, it becomes crucial to maintain compliance and avoid costly errors. For instance, consider the case of a trader who bought Bitcoin at $5,000 and sold it for $60,000. Failing to use crypto tax calculators may lead to underreporting gains, incurring penalties that could wreck the investment. The need for efficient and precise reporting is more important than ever.

In-Depth Analysis of Crypto Tax Calculators

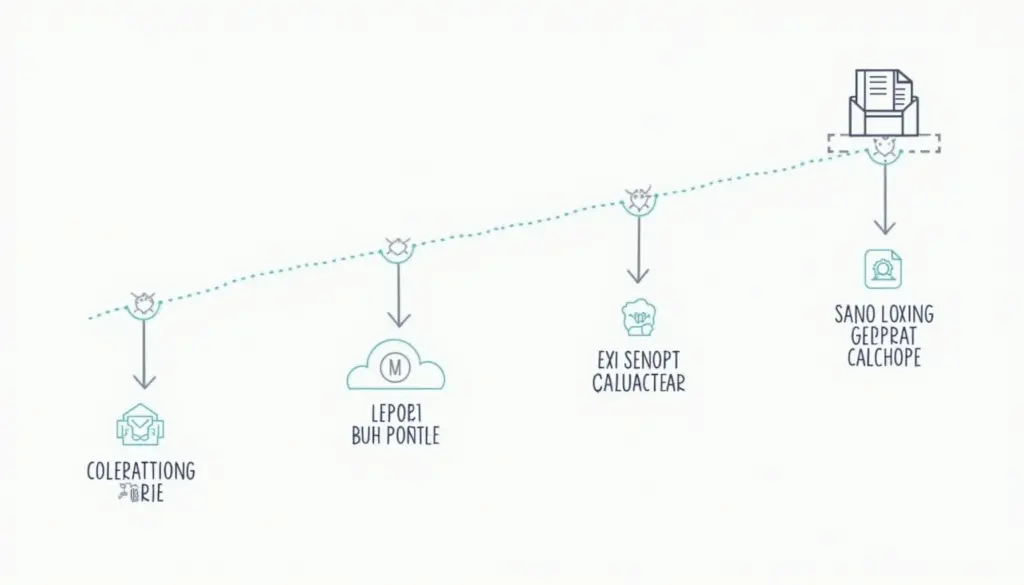

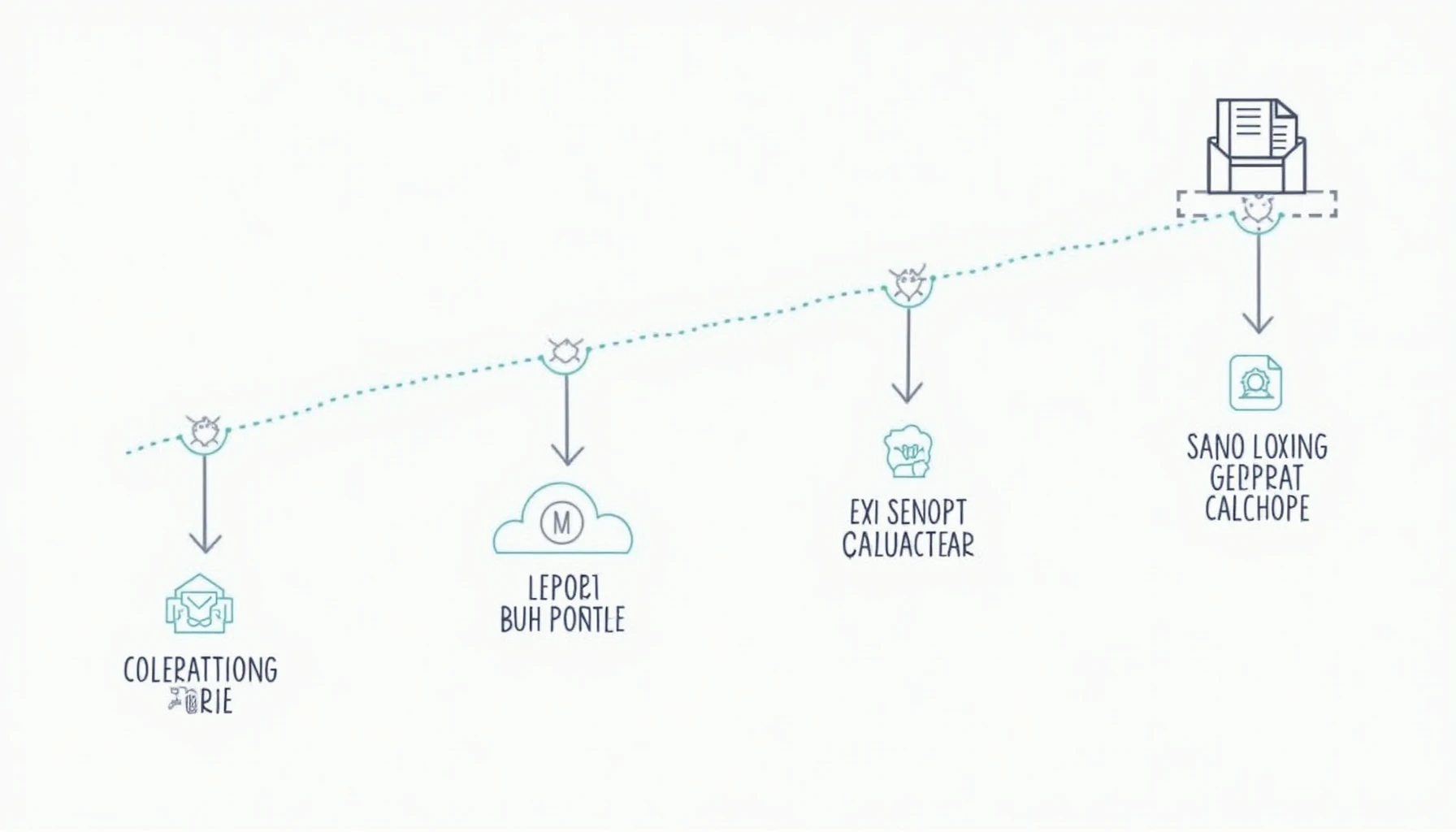

To navigate these complexities, employing effective crypto tax calculators can significantly ease the burden. Here’s a step-by-step breakdown of how these tools operate:

- Data Aggregation: The first step involves compiling transaction history from various exchanges and wallets.

- Cost Basis Calculation: Next, the software calculates gains and losses based on the historical prices at which assets were acquired.

- Tax Report Generation: Finally, it automates the creation of tax reports that meet IRS specifications.

Comparison Table

| Feature | Option A: Software A | Option B: Software B |

|---|---|---|

| Security | High (encryption & 2FA) | Medium (basic security) |

| Cost | Subscription model ($50/year) | One-time fee ($200) |

| Usage Scenario | Best for frequent traders | Good for occasional traders |

According to a recent Chainalysis report, around 85% of crypto investors are not properly reporting their gains. With expected regulations tightening by 2025, using efficient crypto tax calculators is essential for seamless tax filing.

Risk Warnings

Investors must be vigilant about understanding the risks associated with inadequate tax reporting. **Ensure that you back up your data and utilize reputable software** to mitigate potential losses from audits or penalties down the line. Always verify the provider’s credentials before trusting any tool for your tax calculations.

At cryptonewssources, we understand the intricate nature of crypto transactions and the importance of accurate tax reporting. Utilizing crypto tax calculators can aid you in navigating this complex realm, providing confidence in your reporting accuracy.

In conclusion, effectively managing your tax reports with crypto tax calculators is not just beneficial—it’s essential. Stay ahead of the tax game and ensure compliance through reliable software solutions.