Understanding Crypto ETFs and SEC Approval

Understanding Crypto ETFs and SEC Approval

In recent years, the arrival of crypto ETFs has stirred significant interest in the cryptocurrency space, particularly regarding SEC approval. These investment vehicles offer a way for investors to gain exposure to cryptocurrencies without the need for ownership. However, the approval process remains complex, highlighting investor challenges when it comes to securing access to these financial products.

Pain Points in Crypto ETF Accessibility

Investors eagerly await the approval of crypto ETFs by the U.S. Securities and Exchange Commission (SEC). For example, many individuals who wish to diversify their portfolios through digital assets feel frustrated due to delays and regulatory complexities. The potential for attractive returns drives demand, yet the fear of potential losses in an unpredictable market exacerbates anxiety.

Solutions Through In-Depth Analysis

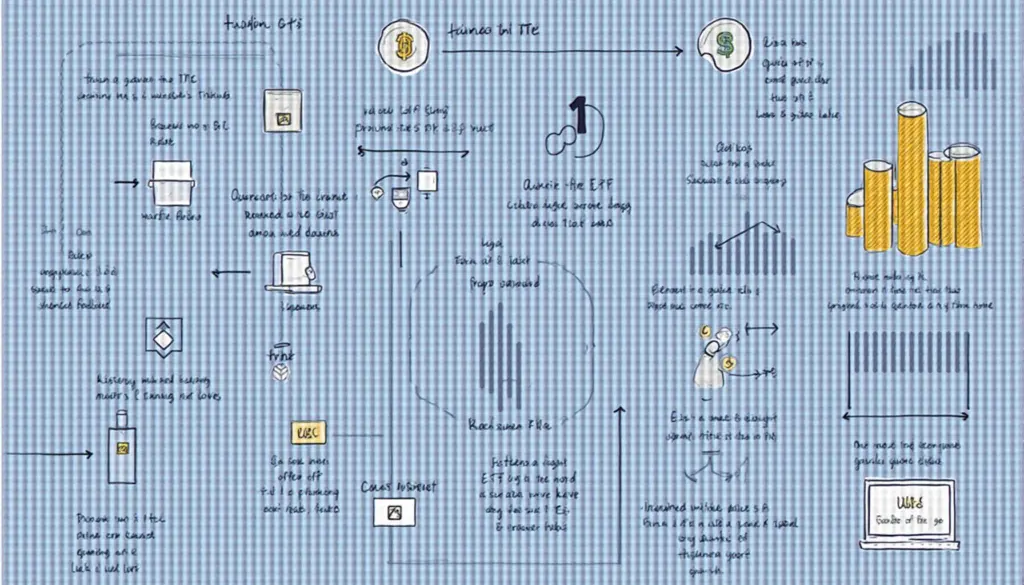

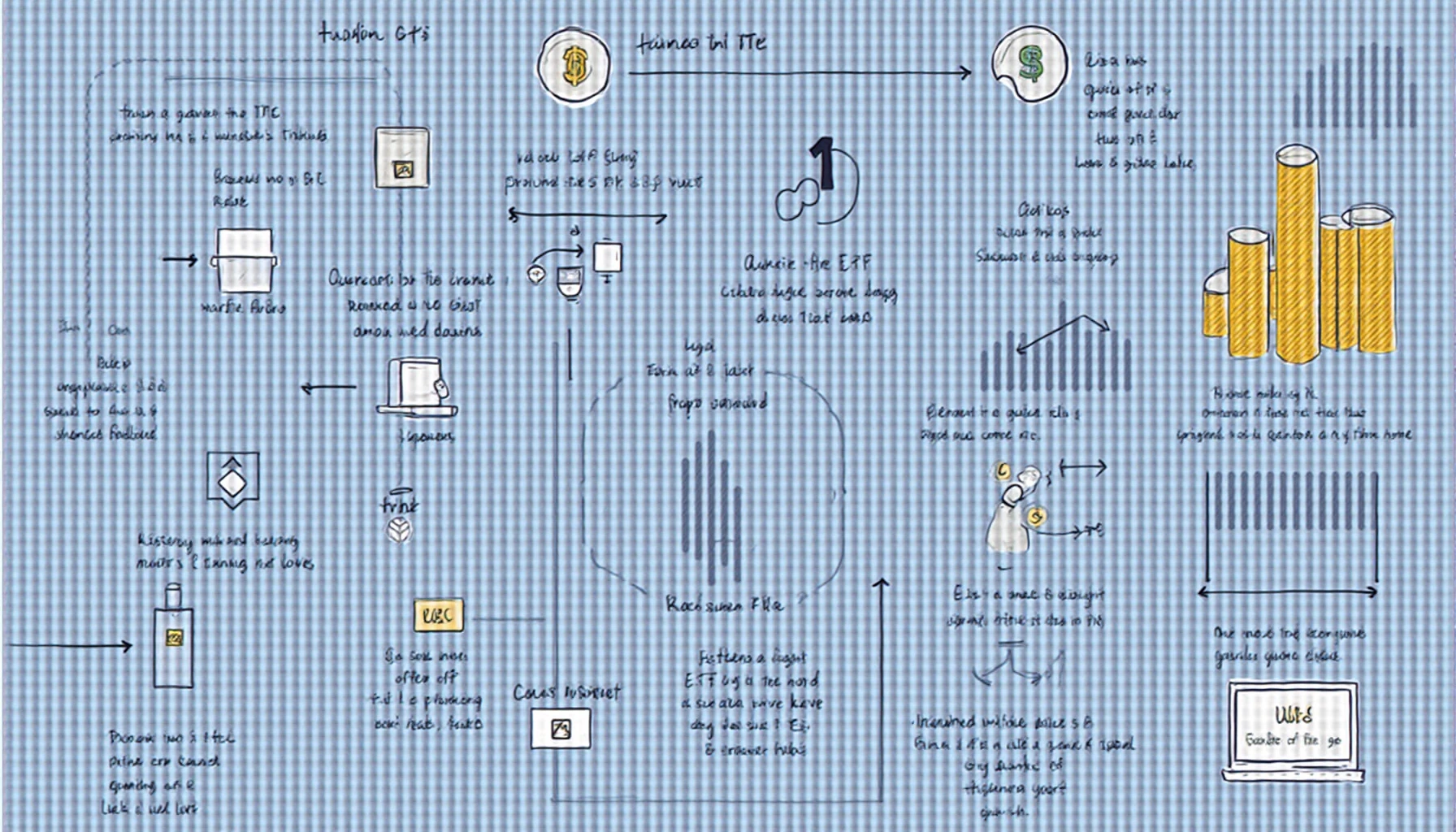

To navigate the complexities of crypto ETFs and SEC approval, it is essential to understand the mechanisms involved in the investment. Let’s explore the main technological strategies that impact this approval process:

- Multi-Signature Validation: This requires multiple private keys to authorize a transaction, enhancing security.

- Real-Time Custody Monitoring: Utilizing advanced technological infrastructure to ensure asset safety in compliance with SEC standards.

- Blockchain Transparency Protocols: Employing transparency tools to track assets effectively in real-time, ensuring compliance.

A side-by-side comparison illustrates how different approaches can yield varying outcomes:

| Criteria | Option A: Multi-Signature | Option B: Single Signature |

|---|---|---|

| Security | High | Medium |

| Cost | Moderate | Low |

| Use Case | Institutional Investors | Retail Investors |

According to a report by Chainalysis, by 2025, over 25% of investors may utilize cryptocurrency ETFs, showcasing the growing trust.

Risk Warnings

While the appeal of crypto ETFs is undeniable, it is crucial to note that several risks accompany potential investments in this space. **Investors should always conduct thorough research and consider diversification strategies.** Market volatility, regulatory uncertainty, and technological challenges could jeopardize funds. Therefore, maintaining awareness of the evolving regulatory landscape and focusing on secure investment options is paramount.

At cryptonewssources, we strive to keep our readers informed about developments in crypto ETFs and SEC approval, helping facilitate informed investments.

FAQ

Q: What are crypto ETFs?

A: Crypto ETFs are investment funds that track the performance of cryptocurrencies, allowing investors to gain exposure without owning them directly, providing advantages in compliance with SEC approval.

Q: Why is SEC approval important for crypto ETFs?

A: SEC approval ensures that the ETFs comply with regulatory standards, which enhances investor confidence and promotes legitimate investment practices in the cryptocurrency market.

Q: How can I invest in crypto ETFs?

A: Once SEC approval is granted, you can invest in crypto ETFs through an investment brokerage that offers access to these financial products.