Crypto Compliance and KYC: Understanding the Essentials for Digital Currency Transactions

Introduction: Why Crypto Compliance Matters

Did you know that around 98% of all cryptocurrency transactions are conducted without proper compliance checks? This raises significant concerns for both users and regulators. As more individuals dive into digital currency trading, understanding crypto compliance and KYC (Know Your Customer) processes becomes critical.

What is Crypto Compliance?

Crypto compliance refers to the adherence to legal and regulatory frameworks governing digital asset operations. This includes ensuring that transactions align with anti-money laundering (AML) laws, data protection regulations, and tax obligations.

For instance, countries like Singapore have established rigorous compliance protocols to protect investors and maintain market integrity. By staying compliant, traders enhance their credibility, making it easier to navigate the volatile crypto landscape.

Understanding KYC: A Crucial Step for Investors

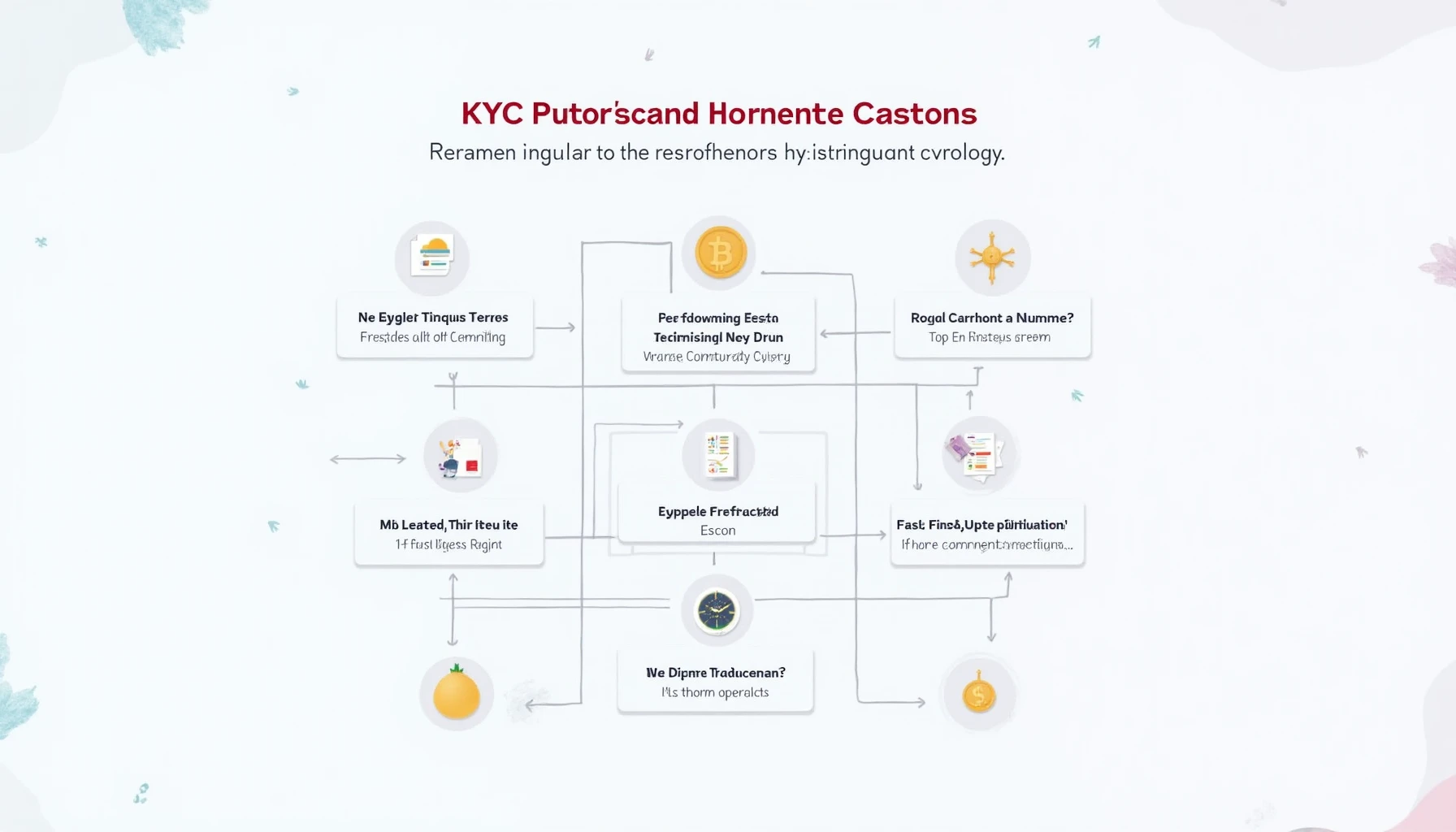

KYC processes are essential in verifying the identity of customers engaging in cryptocurrency transactions. These measures help prevent fraud and money laundering, ensuring that only legitimate users can buy and sell digital assets.

Imagine walking into a bank; you wouldn’t just hand over cash without ID verification. The same principle applies to crypto exchanges. By submitting documentation like a government ID, users confirm their identity, which increases trust in the platform.

How Businesses Can Implement Effective KYC Practices

For businesses operating in the crypto space, implementing robust KYC practices is vital. Here are some key steps:

- Choose effective identity verification tools: Solutions such as Onfido or Jumio provide seamless user verification.

- Adopt ongoing monitoring systems: Continuous identity checks help detect unusual activity.

- Stay updated on regulations: Compliance standards evolve, and staying informed will mitigate potential risks.

The Future of Crypto Compliance and KYC in 2025

According to Chainalysis, by 2025, the Asia-Pacific region’s transaction volume could grow by approximately 40%. This potential growth heightens the importance of establishing stronger compliance mechanisms.

As the market matures, both individuals and businesses will prioritize compliance and KYC to ensure not only legal adherence but also sustainable growth in the ever-evolving crypto ecosystem.

Conclusion: Stay Compliant, Stay Informed

In summary, understanding crypto compliance and KYC is vital in today’s digital currency landscape. By following suitable guidelines and utilizing effective tools, investors can protect themselves and contribute to a secure cryptocurrency market.

Take action today—download our comprehensive guide to crypto compliance!