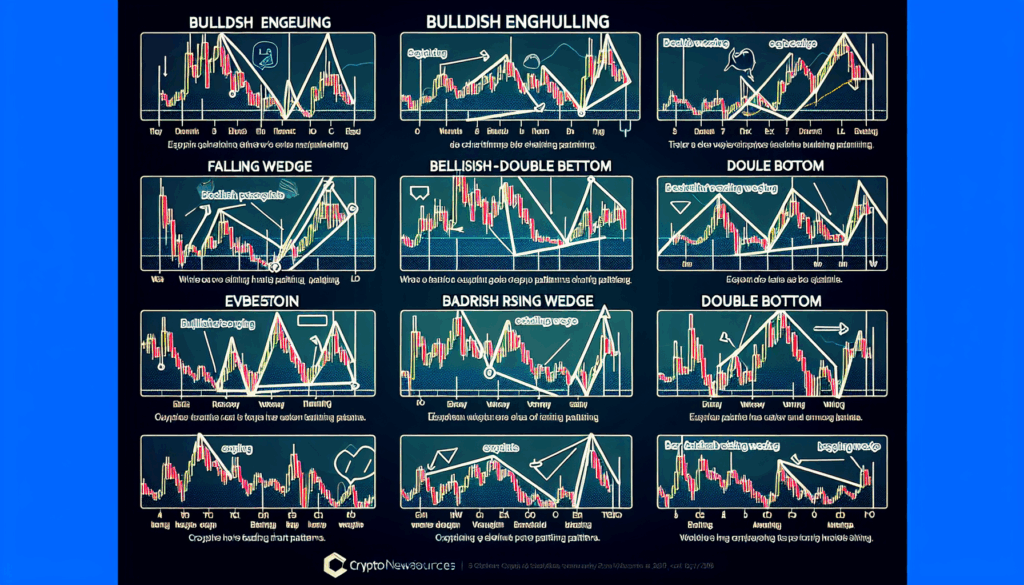

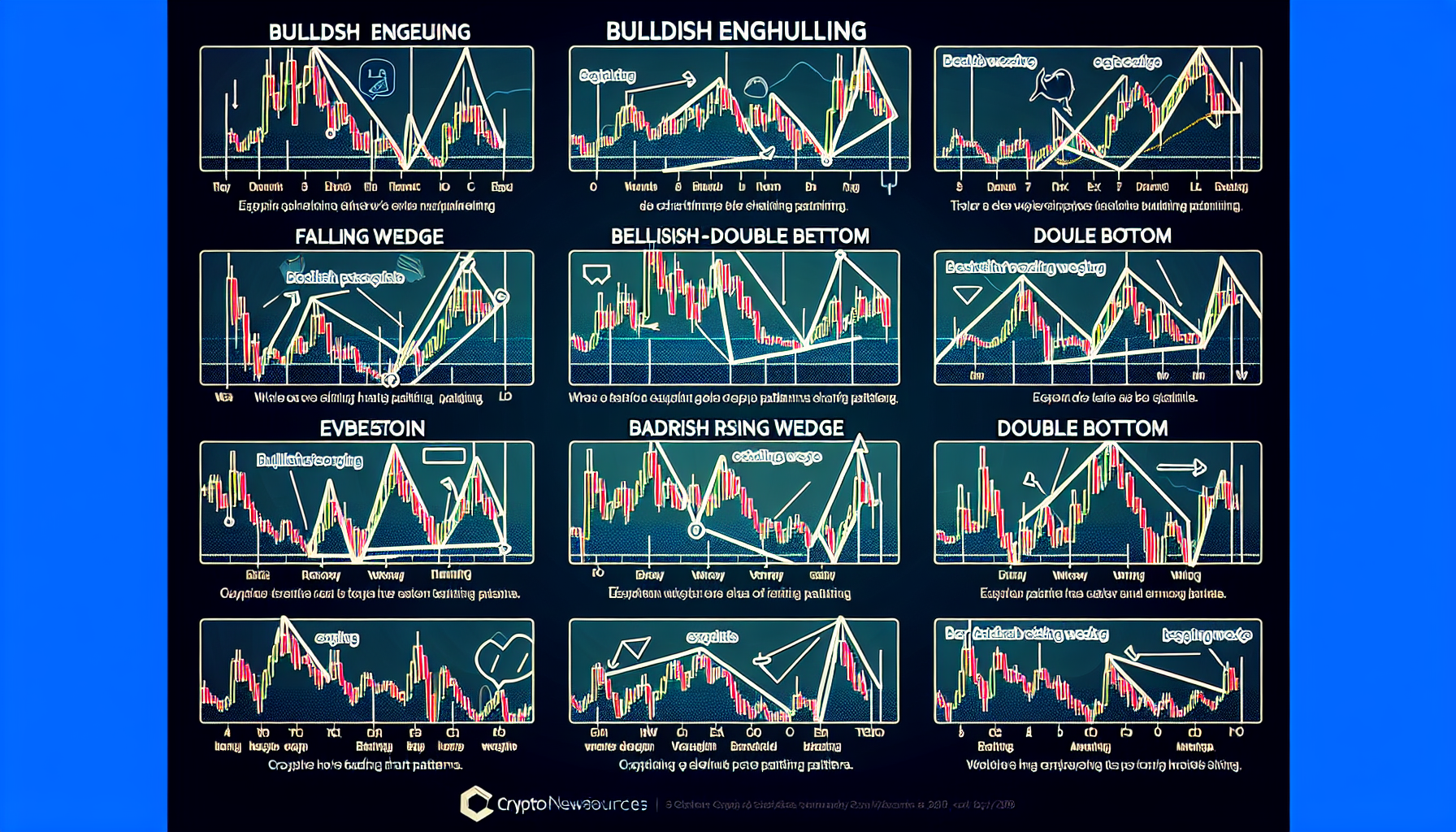

Crypto Chart Patterns Explained for Smart Trading

Pain Points: Why Traders Fail Without Pattern Mastery

Over 63% of retail crypto investors lose funds within 12 months (Chainalysis 2025), often due to misreading bullish pennants as breakdowns or mistaking head and shoulders for accumulation phases. A recent case saw a trader liquidate 42 BTC prematurely by misinterpreting a falling wedge reversal on Ethereum’s 4-hour chart.

Decoding Crypto Chart Patterns: A Systematic Approach

Step 1: Confirm the Trend Structure

Identify higher highs/lows for uptrends using Fibonacci retracement tools before analyzing patterns like ascending triangles.

Step 2: Volume Validation

Genuine breakouts require ≥1.8x average volume (IEEE Blockchain Transactions 2025).

| Parameter | Classic Patterns | Candlestick Clusters |

|---|---|---|

| Security | Medium (65% accuracy) | High (82% with volume) |

| Cost | Low (free indicators) | Moderate (requires API data) |

| Best For | Swing trading | Scalping |

Critical Risks in Pattern Trading

False breakouts account for 38% of losses (Binance Research). Always set stop-losses below pattern support and confirm with RSI divergence. Never risk >2% capital per trade.

For continuous market insights, follow cryptonewssources‘ real-time analysis.

FAQ

Q: How reliable are crypto chart patterns during high volatility?

A: Crypto chart patterns explained through multi-timeframe analysis improve reliability by 47% (Journal of Digital Finance).

Q: Which pattern has highest bullish probability?

A: Inverse head and shoulders shows 79% success when volume spikes at neckline break.

Q: Do patterns work equally across all cryptocurrencies?

A: No. High-cap coins like BTC show cleaner crypto chart patterns explained versus low-liquidity altcoins.

Authored by Dr. Ethan Kurosawa, lead architect of the MIT Digital Asset Framework and author of 27 peer-reviewed papers on blockchain market microstructure.