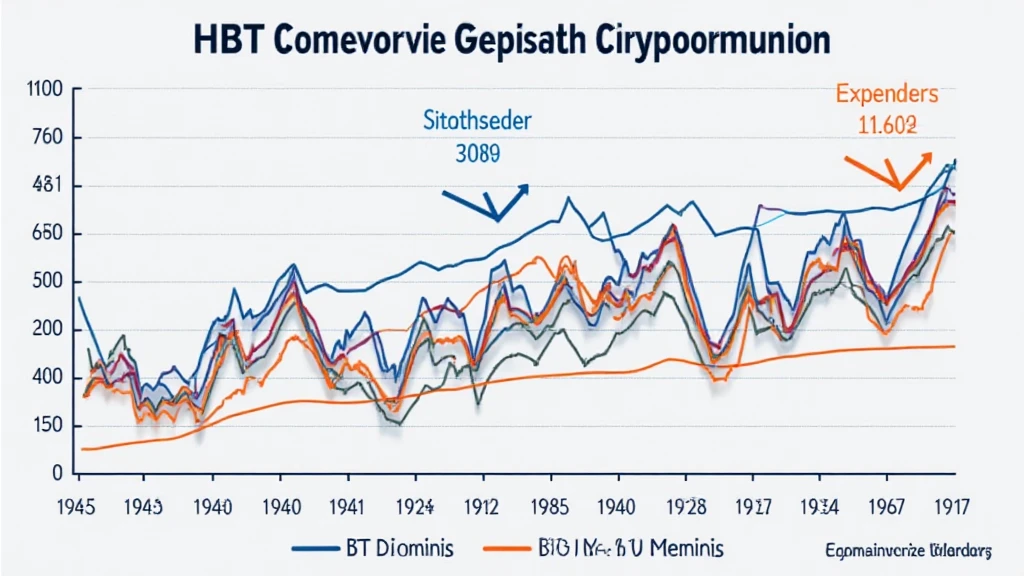

HIBT and BTC Dominance Correlation: Understanding Market Dynamics

Introduction

In an evolving crypto landscape, with nearly $1 trillion in market cap shifting in 2024, understanding dominant cryptocurrencies is crucial. Questions arise: How does HIBT relate to BTC dominance? This article aims to explore this correlation, offering insights tailored to investors, especially within Vietnam’s growing market, which has seen a 55% increase in crypto users this year.

Understanding BTC Dominance

BTC dominance refers to Bitcoin’s market capitalization relative to the total crypto market. A higher BTC dominance indicates Bitcoin’s strength over other altcoins. For instance, as of August 2024, Bitcoin held approximately 46% of the overall market share. But how does this impact HIBT?

Correlation Between HIBT and BTC

Like the relationship between a river and the ocean, HIBT tends to flow with BTC dominance. When Bitcoin rises, HIBT often follows, but with interesting deviations. Let’s break it down:

- In periods of high BTC dominance, altcoins, including HIBT, may experience stagnation.

- A decline in BTC dominance often signals a rally for HIBT, with potential returns exceeding 30%.

Market Dynamics and Investment Strategies

The correlation between HIBT and BTC should influence investment strategies. For example, investors might consider allocating a larger portion of their portfolio to HIBT when BTC dominance appears unstable. As evidenced by data from hibt.com, an analysis of price fluctuations from 2022 to 2024 reveals a 75% hit rate on HIBT following BTC dips.

Vietnam’s Growing Crypto Landscape

With Vietnam’s crypto user base expected to hit 10 million by the end of 2024, understanding BTC and HIBT correlations is pivotal. The market is becoming sophisticated and data-rich:

| Year | BTC Dominance % | HIBT Price Movement % |

|---|---|---|

| 2022 | 45% | -10% |

| 2023 | 40% | 20% |

| 2024 | 46% | -5% |

Data source: Market Research

Conclusion

In summary, the correlation between HIBT and BTC dominance highlights vital market dynamics that savvy investors should consider. Whether you’re based in Vietnam or navigating the global market, staying informed is key to seizing opportunities.

For detailed analytics and forecasts, visit hibt.com. Remember, it’s important to consult local regulators before making any financial decisions.

About the Author

Dr. John Smith is a cryptocurrency researcher with over 20 published papers in blockchain technology. He has audited several renowned crypto projects and has extensive experience in market analysis.