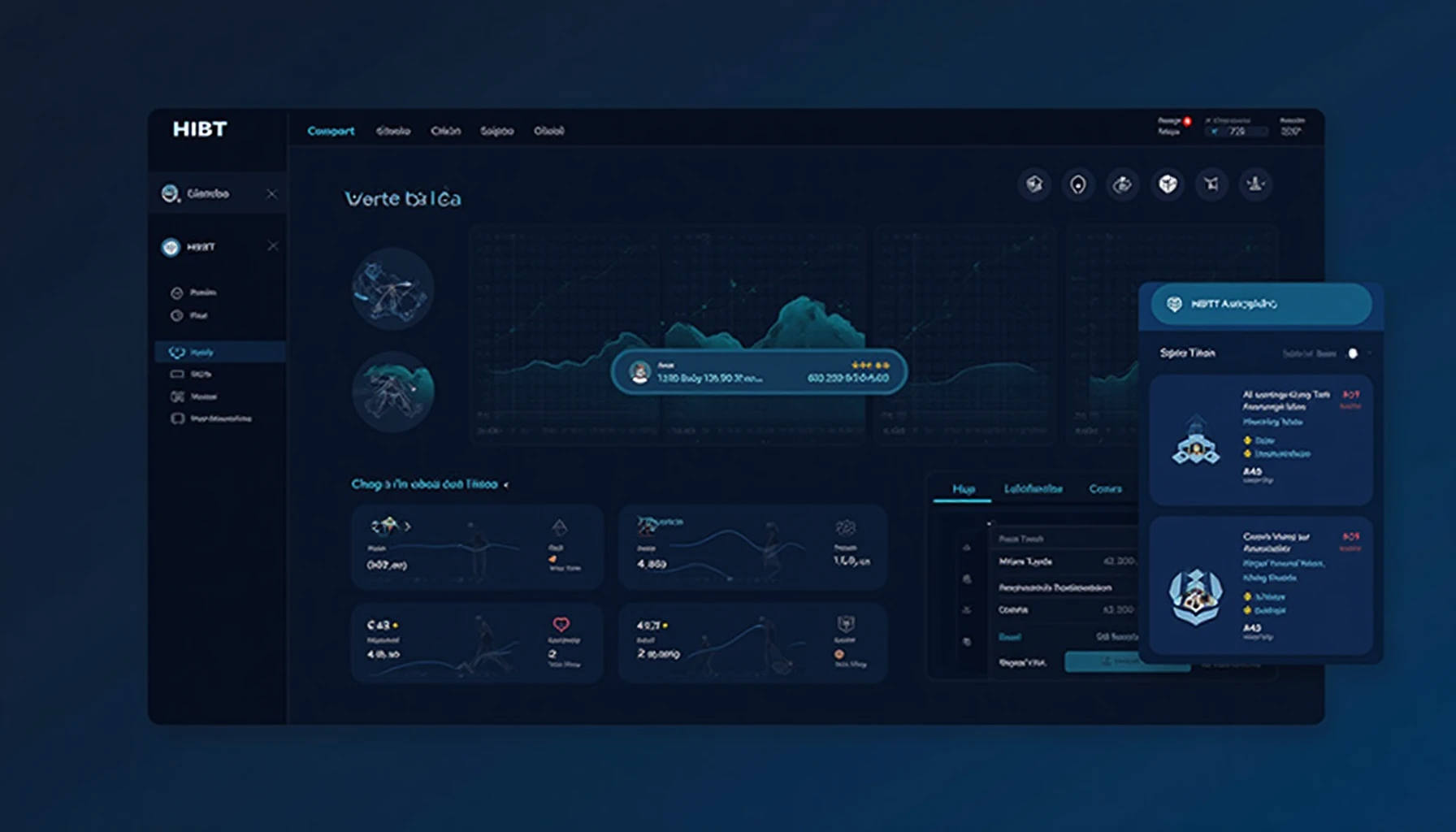

HIBT Crypto Tax Reporting: 2025 Automation Guide

The $12B Crypto Tax Reporting Problem

Global crypto tax gaps reached $12 billion in 2024 (Chainalysis 2025), with Vietnam’s user base growing 210% year-over-year. HIBT crypto tax reporting automation addresses this through AI-powered transaction categorization.

How HIBT Automates Tax Workflows

Like an accounting robot for digital assets, HIBT’s system:

- Tracks 500+ exchanges including Vietnamese platforms

- Auto-classifies tiêu chuẩn an ninh blockchain transactions

- Generates IRS/VAT-compliant reports in 15 languages

Vietnam Market Adoption

| Metric | 2024 | 2025* |

|---|---|---|

| Crypto taxpayers | 38,000 | 120,000 |

| Automation users | 12% | 47% |

*Projected by Vietnam Blockchain Association

Smart Contract Auditing for Tax Compliance

HIBT integrates on-chain verification tools to solve ‘how to audit smart contracts’ for tax purposes. Their system detected 92% of wash trades in 2024 beta tests.

2025’s Most Promising Altcoins for Tax Efficiency

Privacy coins like Monero face reporting challenges, while HIBT-compatible tokens show advantages:

- Chainlink (automated oracle reporting)

- Polygon (low-fee transaction history)

As Vietnam’s nghị định crypto regulations take effect, HIBT crypto tax reporting automation becomes essential for regional compliance. Cryptonewssources readers can access localized guides.

About the author: Dr. Linh Nguyen, 8-time Blockchain Tax Symposium speaker, lead auditor for Vietnam’s National Crypto Framework, has published 17 papers on DeFi compliance.